Infrastructures : a key asset category for the climate

What exactly do we mean by ‘ infrastructure’?

Why does the success of the energy transition depend on such assets?

To what extent should climate risks be better incorporated into infrastructure portfolio management?

What follows is a general overview that Carbone 4 has put together of this asset category and the issues that link it to climate change.

Infrastructure is a very hot topic at the moment; from the privatisation of Aéroport de Paris to the €20bn 10-year high-speed broadband plan, not forgetting record capital campaigns from French firm Ardian and Swedish firm EQT, there is certainly no shortage of opportunity, or of enthusiasm concerning investors.

Something else that has been in the news recently is the tragic collapse of the bridge in Genoa - a reminder of the critical importance of maintaining current infrastructure in good condition as vital organs that help keep our economy alive.

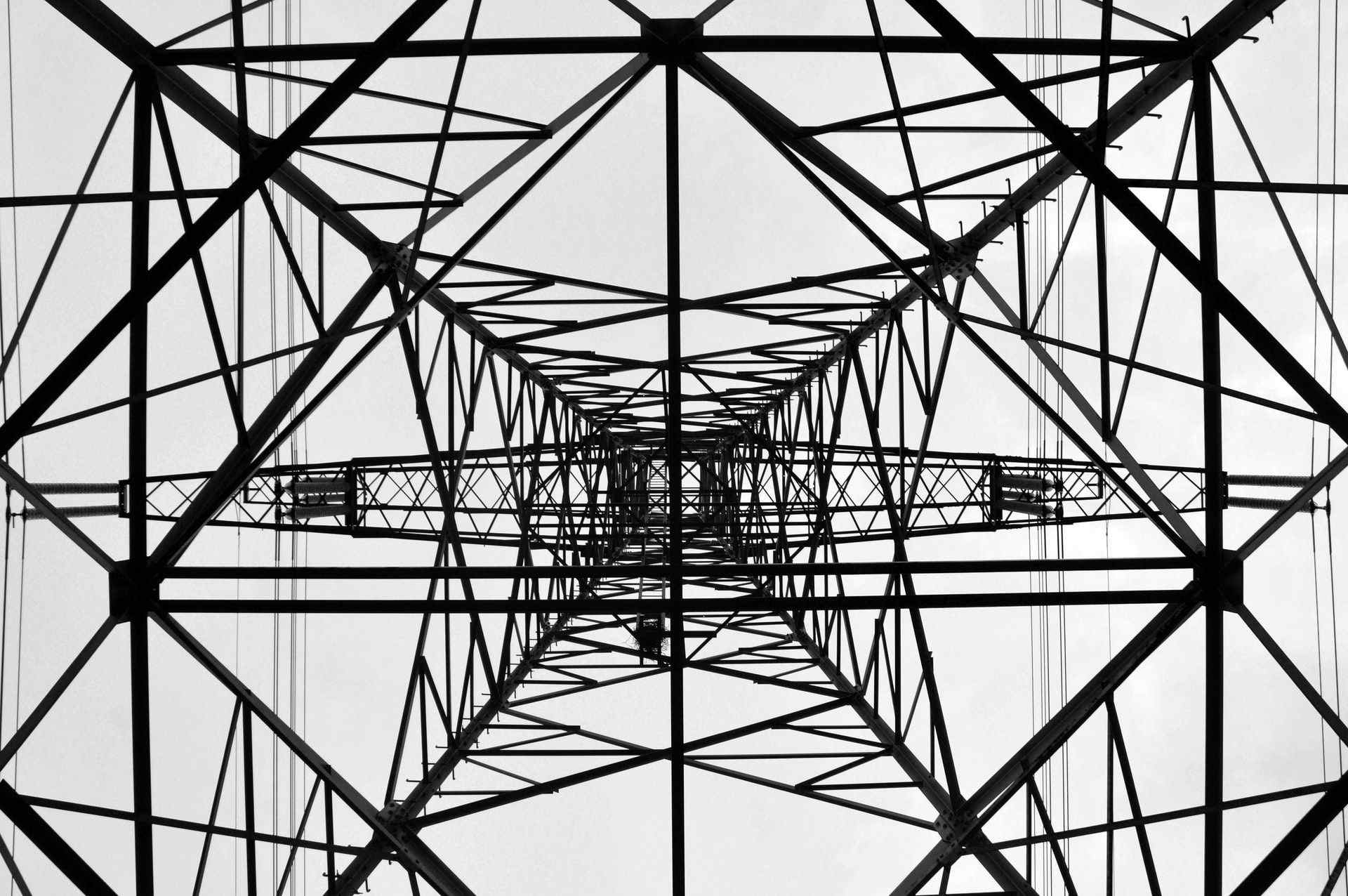

Infrastructure also plays a key role in the issues associated with the climate transition. It might enable our economy to develop, but infrastructure also results in the generation of emissions that contribute to climate imbalance, which can in turn lead to such physical assets being exposed to increased risks.

Conversely, an ambitious emissions reduction policy could disrupt the longterm stable and predictable returns on which the success of this asset category relies upon.

How should infrastructure investors and managers be interpreting all of these challenges and opportunities?