Materials of the dematerialized: are there raw material supply risks for companies in the digital sector ?

With the development of ever more powerful computers and smartphones, the multiplication of connected devices in our offices and homes, and the promises of Artificial Intelligence and 5G, digital technologies have us ever more dreaming of a "dematerialized" economy, freed from the physical limits of the real world.

However, the digital sector is becoming increasingly resource-hungry, and not just in terms of fossil fuels. Dependent on raw materials such as copper, gold and lithium, digital technologies also rely on much lesser-known metals such as indium, tantalum and gallium to manufacture the equipment that enables it to exist (computers and smartphones, but also transmission networks and data centers).

In this analysis, we explore the question of the sector's resource consumption. More specifically: are there any raw material supply risks for the digital sector ? While we don't expect to come up against geological constraints (i.e., "emptying the reserves") in the next 10 years, other issues are likely to restrict access to the raw materials on which the digital sector depends: competing uses, geopolitical risks, environmental and social risks, and the illusion of recycling.

Context: the strong growth of the digital sector

The digital sector alone accounted for 4% of global greenhouse gas emissions in 2019. With strong growth, the digital sector's carbon footprint could increase 60% by 2040[1]. It also accounts for 4.2% of primary energy consumption and 0.2% of water consumption worldwide[2].

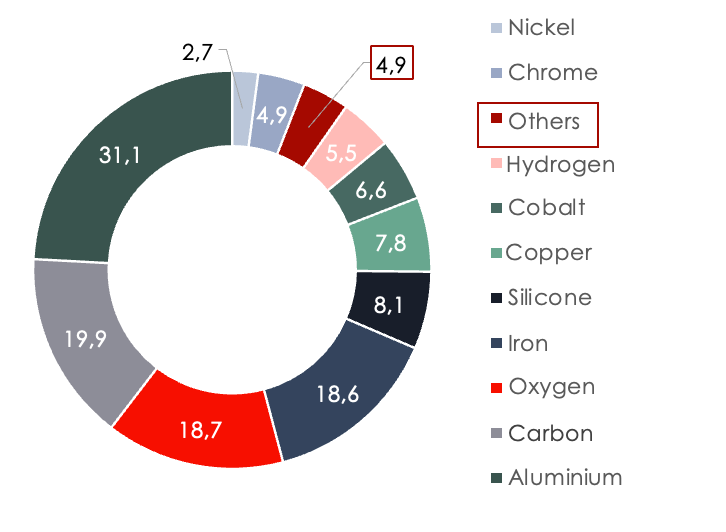

But the environmental impact of digital technologies is not limited to greenhouse gas emissions or water consumption. The industry is also dependent on a growing number of critical resources. On average, a smartphone is made up of 50 to 70 chemical elements[3], used in minute quantities for highly precise and complex applications. These elements are essential to achieve the record performances and costs seen today in tech.

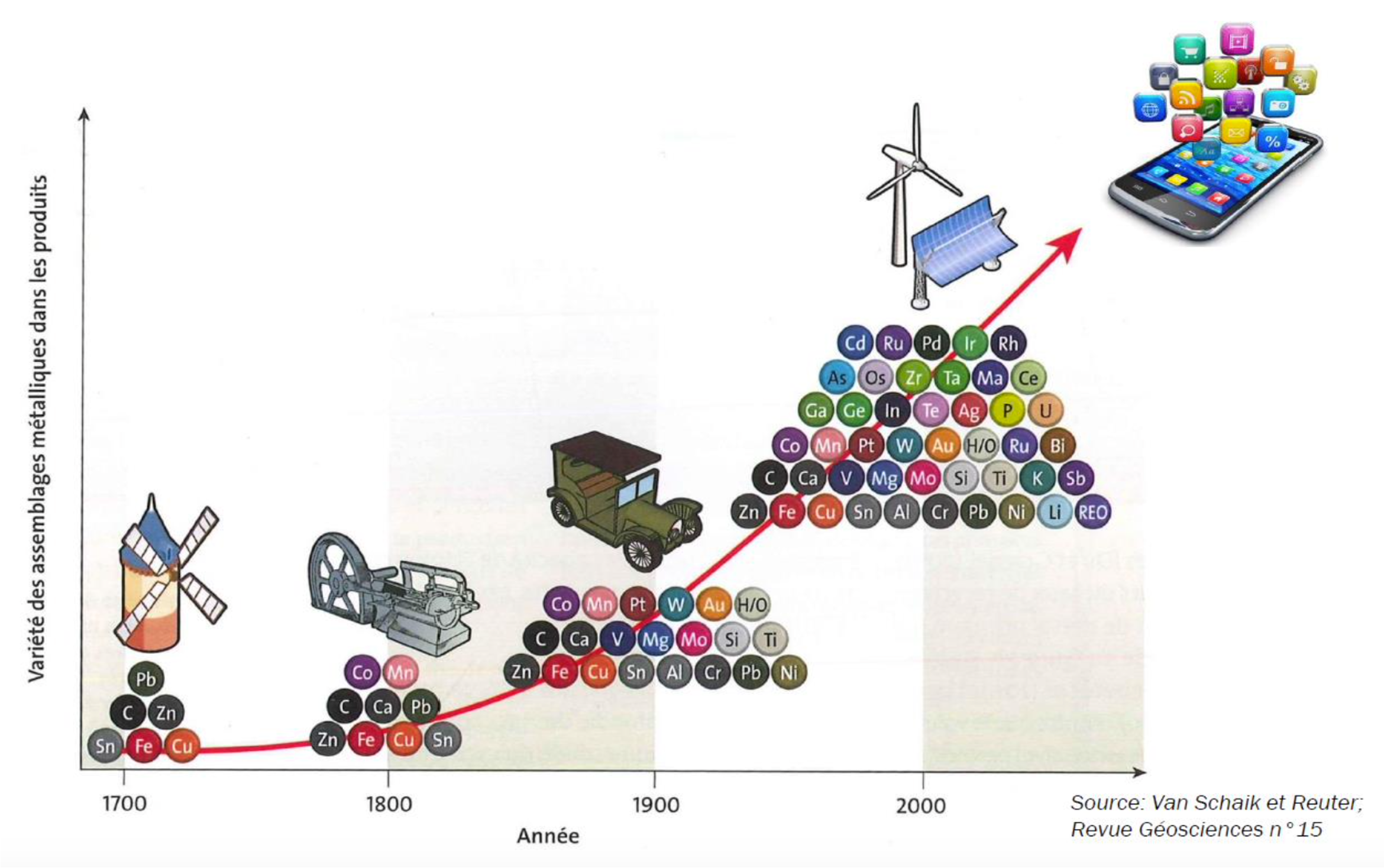

Demand has increased not only in volume - but also in diversity

The digital sector contributes to the exponential consumption of raw materials in our economy - particularly that of metals. Between 1980 and 2008, global demand for metals almost doubled (87% increase)[4]. Demand has increased not only in volume - but also in diversity, as shown in Figure 1, which traces the increase in the number of metals used with successive technological evolutions. Between 1980 and 2010, the number of metals used was multiplied by 6, mainly due to the ICT (Information & Communication Technologies) industry. By 2050, to meet projected demand, the quantity of metals required could represent 3 to 10 times current production volumes. This would mean producing more metal over the next 35 years than we have produced since Ancient history[5].

Faced with this exponential consumption of raw materials, isn't the digital sector at risk of tensions over the raw materials on which it depends ? We explore this question in this article, focusing on a few critical raw materials for the digital sector, and the risks they face (economic, technological, supply, geopolitical, and environmental).

Five critical raw materials for the digital sector

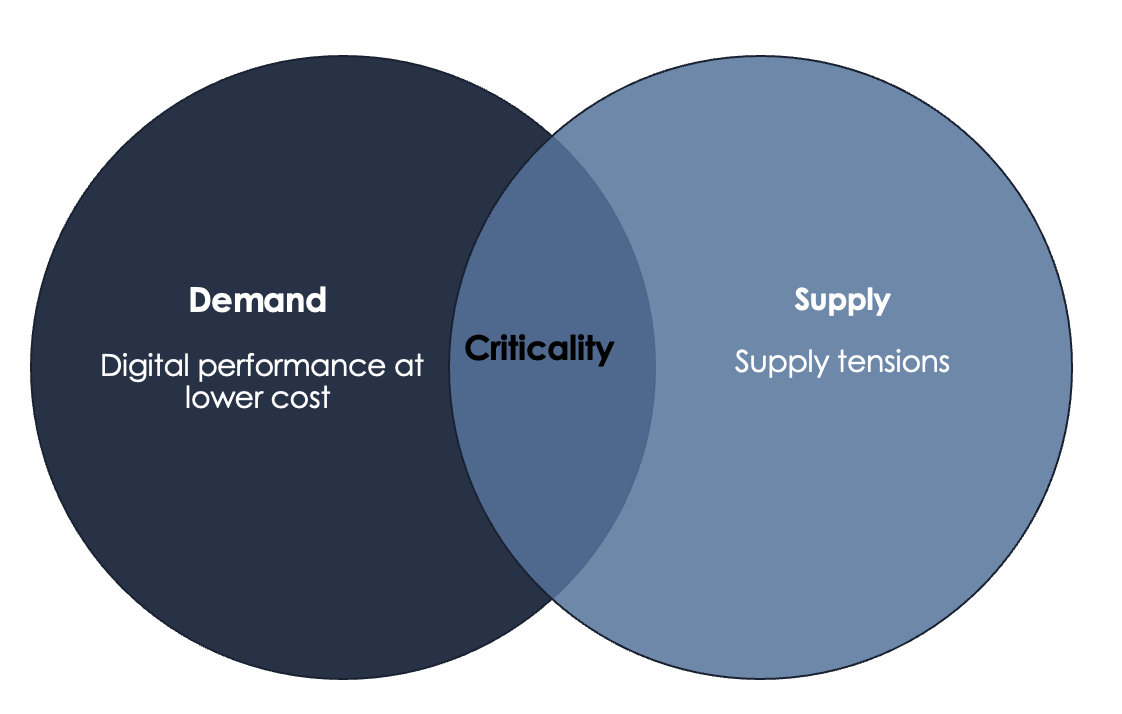

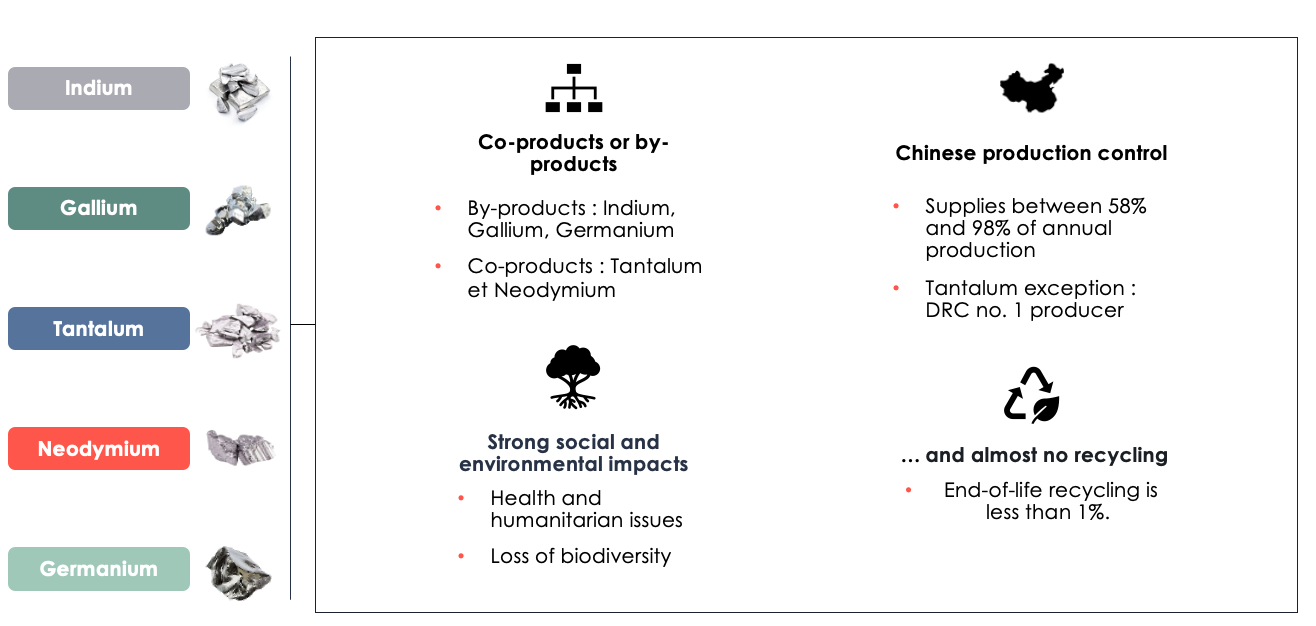

Let's take a closer look at five critical raw materials for the digital industry : indium, gallium, tantalum, neodymium and germanium. By cross-referencing several studies (Bureau de recherches géologiques et minières - BRGM, European Commission, France Stratégie, etc.[6]), these five elements stand out as critical for the digital sector, as they are at the crossroads of two factors :

- Demand : the use of these materials is essential if digital technology is to perform at current technological standards and costs. Alternatives to these materials would, for the most part, increase the production costs of digital equipment.

- Supply : they face supply vulnerabilities, even though they are used almost exclusively in digital applications.

Essential uses for the digital sector

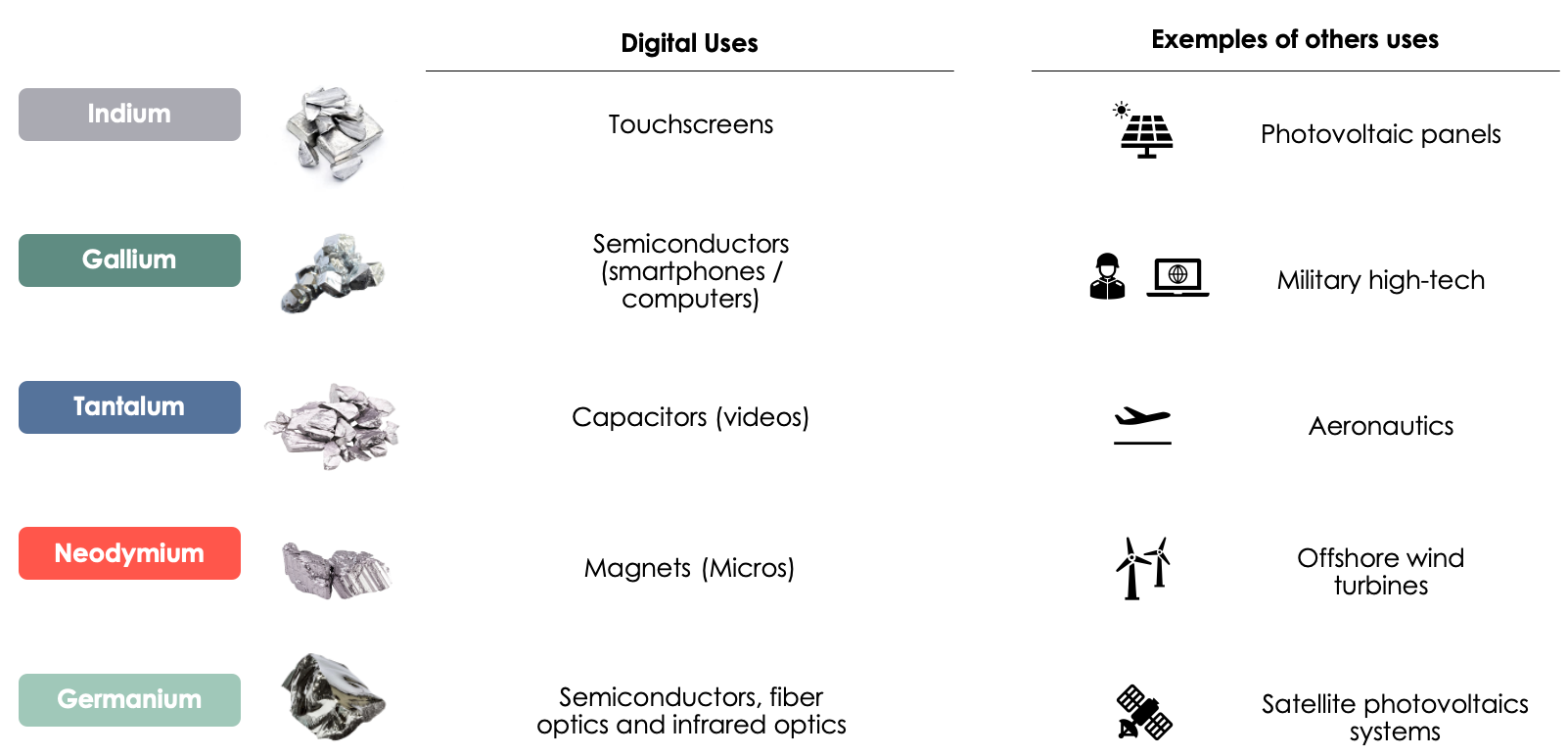

In terms of demand, our studied raw materials have a very specific use in user terminals. Although they are present in minute quantities - representing less than 100 mg[7] of the total weight of a conventional smartphone - they enable high levels of performance to be achieved, both in terms of quality and cost. They are therefore poorly substitutable, as they have no equivalent in terms of cost and/or quality.

Figure 3 gives an overview of the five raw materials and their use in the digital sector. Indium, for example, used in the form of tin-doped indium oxide, enables the quality of touch screens and LCDs we have today. Zinc or tin oxides are possible substitutes, but they do not deliver the same performance[8]. This is a material with which we interact on a daily basis, without realizing the complexity of its value chain and its environmental impacts (detailed later in this article).

Furthermore, these five raw materials are used almost exclusively in the digital sector - which conditions and sizes their demand (the sector accounts for between 30 and 95% of their consumption)[9]. With the frantic race to bring out the latest models and the increase in screen size (e.g.: at 31 cm in 2010, the average diagonal of flatscreen TVs is set to increase to 65 inches in 2025[10]), the trend shows no sign of slowing down.

Raw materials subject to supply tensions

The value chains for these metals are complex, especially because of the way mining projects operate. These projects span decades and include several phases : mineral exploration to find exploitable reserves, extraction, refining, and manufacturing stages. Our five raw materials face several supply tensions :

- Co-products or by-products : Like most mining resources, these materials are co- or by-products, substances that are not present in sufficient quantities in the earth's crust to justify mining on their own. Their production therefore depends on the production of other metals. There is no such thing as a mine dedicated to a single material. Only a few main substances, such as copper, iron or zinc, can justify a mine. The existence of co- or by-products ensures economic profitability. For example, indium is produced during the zinc refining stage. However, zinc refineries also depend on other co-products to achieve economic profitability. The mining industry is therefore linked to multiple markets, making them all interdependent. Producing more indium means producing more zinc and co-products, and finding markets for each.

- Production monopoly : The refining of these materials is almost entirely concentrated in China (in 2022, China produced 58% of the world's indium, 98% of gallium and 70% of rare-earth elements)[11]. This Chinese monopoly makes our five raw materials vulnerable to geopolitical tensions. It should be noted that China's share of global production of these materials has been partly reduced as a result of the US protectionism implemented by the Trump administration against Chinese products, particularly for rare-earth elements[12].

- Strong social and environmental impacts : In addition to GHG emissions, extraction and refining have a strong impact on environmental and human health. Open-pit mining alters the landscape, the soil and the local hydrological regime. Ore extraction and element separation generate chemical effluents (cyanide, arsenic, lead, sulfates, mercury, etc.)[13],[14]. In addition to these materials, which are harmful to biodiversity and human health, the production of digital raw materials generates a colossal quantity of inert waste, resulting from the crushing of rocks[15]. As we cross more planetary boundaries, how long will we accept these harmful impacts, which are accelerating with the increased consumption of these raw materials ? Raw materials are therefore subject to transition risks as well[16]. This also applies to social issues. A non-negligible proportion of the supply comes from illegal child labor operations[17]. In the Democratic Republic of Congo, one of the main producers of Tantalum, armed conflicts over the exploitation of natural resources have been raging for 20 years. How much longer will we accept this exploitation ?

- Virtually zero recycling : Finally, in the face of these raw material supply challenges, recycling is no panacea either. Today, these raw materials are neither recycled nor recyclable. Their end-of-life recycling rates are below 1%[18]. The minute, mixed quantities used in terminals prevent efficient recycling methods at viable economic costs. This difficulty in recycling terminals also comes with its share of environmental and social consequences. Some of this digital waste ends up in landfills on the other side of the world. The Agbogbloshie e-waste dump in Ghana is one of the largest in the world[19].

Sufficiency as a means of action

The current digital consumption model seems unlikely to be sustainable, given the nature of the tensions on raw materials. According to CISCO, the number of terminals connected to an IP address will be three times greater than the world's population in 2023[20]. Structural changes will have to be considered to mitigate the sector's impact. With this in mind, several solutions can be considered, starting with user terminals:

- Influencing demand : Promote rational screen consumption (restrain the increase in the number of screens per person), promote longer lifespans, increase the operational life of applications and software, and encourage the use of refurbished devices rather than buying new ones.

- Influencing supply (less resource-hungry) : Design devices with lower performance levels to reduce the material footprint, design devices that promote recycling at end-of-life.

Moreover, this desirable sufficiency is not limited to terminals alone. We also need to question the models of other digital components such as data centers and network infrastructures (deployment of 5G across an entire territory, programmed obsolescence of 2-3G, growth in the number of data centers, etc.).

Beyond questioning supply risks, digital technology must stop representing an ideal of conspicuous consumption, which hides the physical and geological realities. This is the paradox of the sector: the promise of digitalization as a means of optimizing other sectors of activity comes up against a lack of awareness of the unsustainable materiality of digital technology.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.