Corporate Sustainability Reporting Directive (CSRD): Who is affected, and when?

The year 2023 marks a major change in environmental reporting in Europe, with the arrival of the Corporate Sustainability Reporting Directive (CSRD).

The CSRD replaces the previous European climate reporting standard, the Non-Financial Reporting Directive (NFRD), which had been adapted in France to create the DPEF (“Directive de Performance Extra Financière'').

The CSRD, adopted by the European Commission at the end of 2022, substantially expands the number of companies covered, as well as the information they will be required to disclose on various environmental and social indicators, including climate.

This article, written by Carbone 4's Regulatory Expertise team, appears after the publication of the CSRD’s delegated act by the European Commission[1]. This delegated act, which specifies the information to be reported, substantially reduces the scope of this law compared to the ambitious standard proposals published by EFRAG[2] in November 2022[3]. The content of the CSRD are deciphered in a second article.

This article comes after an amendment by the European Commission, modifying the thresholds and timetables for certain companies (large companies not yet subject to the NFRD and listed SMEs). Adopted by the Commission on October 17, 2023, but not yet final at the time of writing. This amendment is taken into account in this article.

In this first article, we focus on the who and when: which companies will be subject to CSRD in Europe, and by when? We zoom in on French companies.

1. Who is affected by the CSRD? What changes will take place?

The implementation of the CSRD and its transposition into national laws will shake up the European regulatory landscape in terms of climate reporting. Prior to this new regulation, 11,700 European companies were subject to non-financial reporting obligations. This figure will rise to around 50,000 once the CSRD comes into force (depending on the thresholds adopted)[4]. So, who are these new companies or legal entities subject to the regulations? How do these new obligations fit into the regulatory context of EU countries? How can we anticipate these changes? We will examine these questions through the prism of French regulation. As the EU's second largest economy[5], France also has its own particularities in terms of extra-financial obligations, which we will decipher in this article.

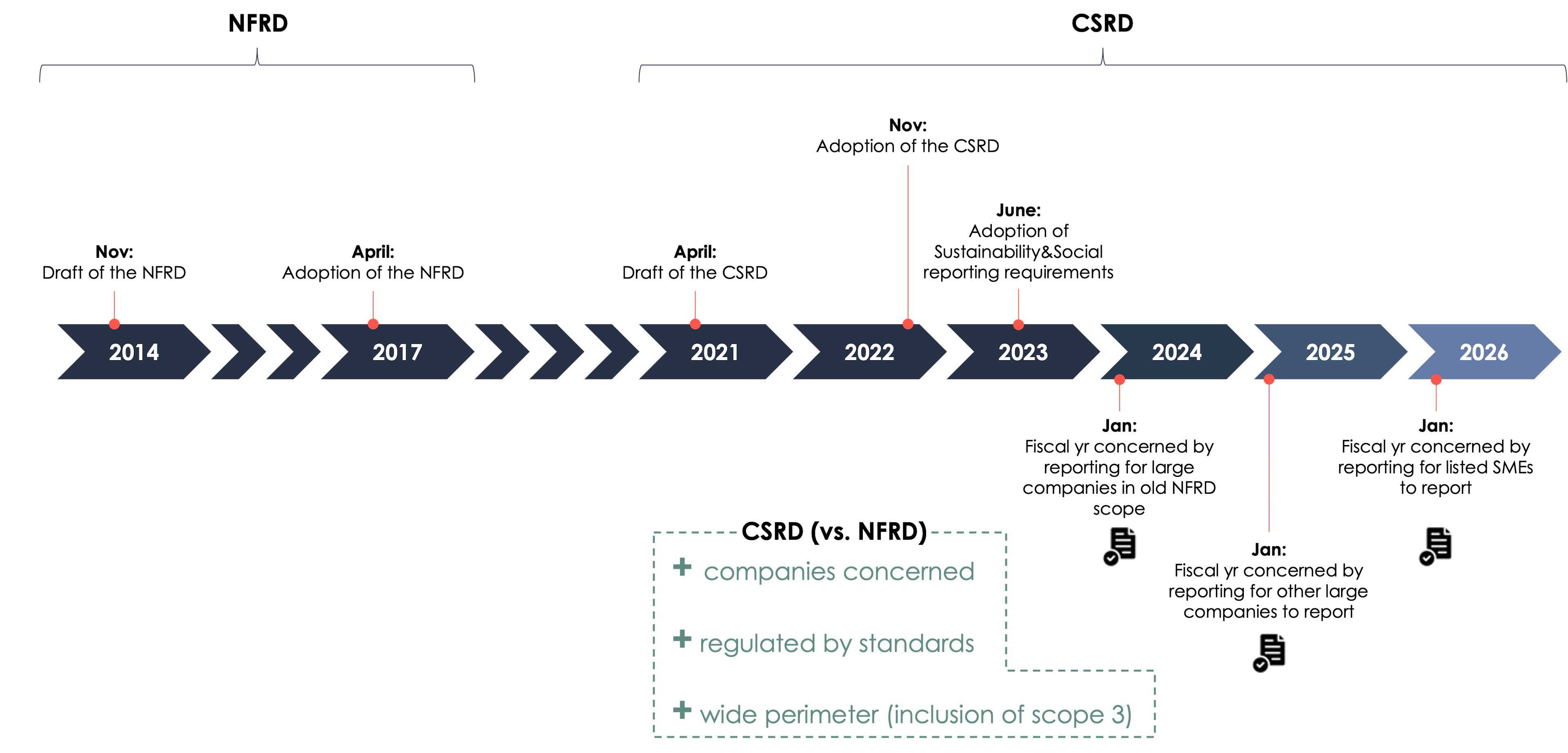

Application of the CSRD will begin in fiscal 2024 and extend over time. The Council of the European Union, the European Parliament and the European Commission[6] have established the following timetable:

- Declarations in 2025 regarding the 2024 financial year for companies already subject to the NFRD;

- Declarations in 2026 regarding the 2025 financial year for other large companies;

- Declarations in 2027 regarding the 2026 financial year for listed SMEs, with a 2-year deferral option;

- Declarations in 2029 regarding the 2028 financial year for foreign companies with a European subsidiary.

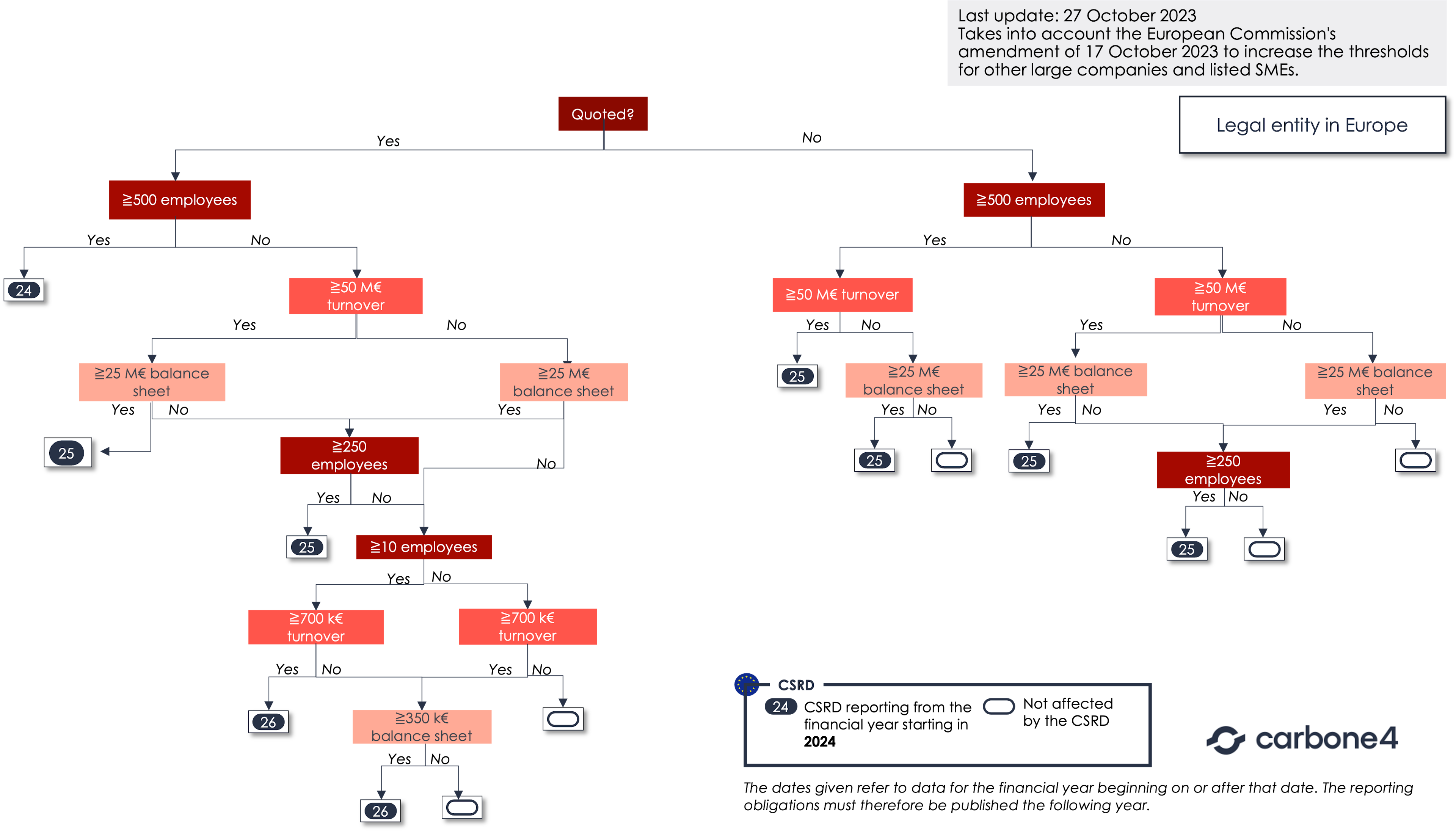

The diagram below shows whether a company (or legal entity) is concerned by the CSRD and from when.

2. France: pioneer in the publication of extra-financial and climate data by companies

In France, the culture of extra-financial data transparency goes back a long way. Since as early as 2010, Article 75 of the Grenelle II law introduced a tool for measuring and monitoring the greenhouse gas emissions of organizations and local authorities, the Bilan des Émissions de Gaz à Effet de Serre (BEGES). Companies with over 500 employees in mainland France are required to report their direct emissions (scope 1 and 2), and for certain companies, significant indirect emissions[7]. France is thus the only country in the world to require reporting of both direct and indirect emissions (Scopes 1, 2 & 3)[8]. France is therefore one of the most advanced countries in terms of climate reporting regulations[9]. Furthermore, many French and international companies have taken the lead, and not waited for regulations to start sharing their climate strategies.

In 2017, France transposed the European NFRD into national law through the DPEF (Déclaration de Performance Extra Financière). The transposition includes the obligation to report Scope 3 greenhouse gas emissions, thus going beyond the requirements of the initial European directive, the NFRD. Today, the CSRD, which replaces the NFRD, will further flesh out and structure climate reporting, and significantly increase the number of companies concerned.

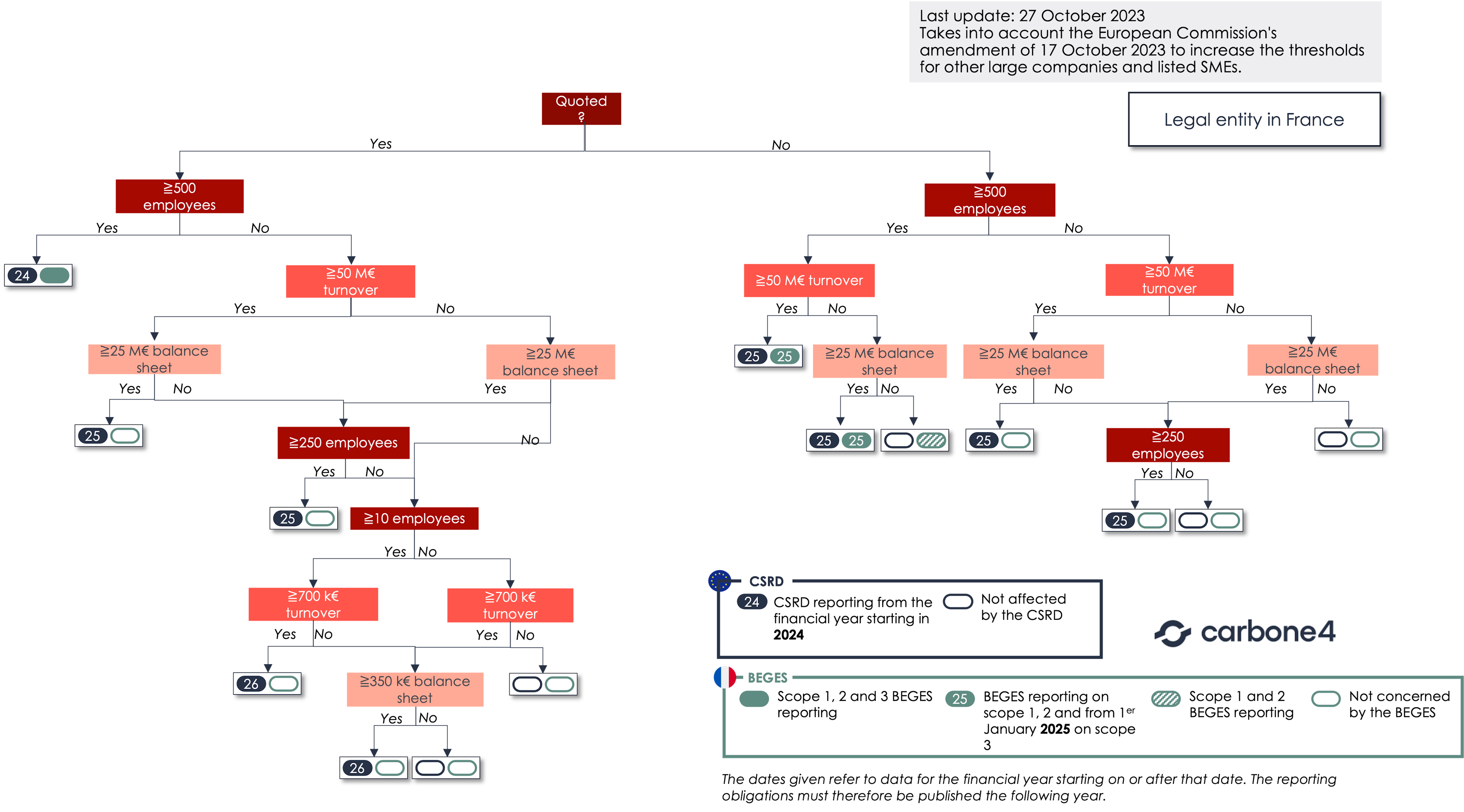

The diagram below describes the differences and complementarities in application between the BEGES[10] (reporting standard in force in France, in green) and the upcoming CSRD, over the next few years (dates in blue). While some 5,000 private and public-sector companies are currently required to publish a regulatory BEGES, it is estimated that a total of some 8,000 companies will be subject to reporting following the introduction of the CSRD and its transposition into French law (variable depending on the final company thresholds adopted)[11].

In conclusion, the new European climate reporting standard, CSRD or "Corporate Sustainability Reporting Directive", not only brings significant changes to the information to be disclosed, but also extends the number of companies required to share (and therefore collect) their climate data.

According to the adopted thresholds, around 50,000 companies in Europe will have to disclose climate information, compared to around 12,000 at present.

Our next article will focus on the content of the standards - analyzing the nature of the substantive changes brought about by the CSRD, and particularly on the climate aspect. Indeed, European companies will be required to better understand their impact on the climate, as well as the impact that climate change will have on their operations.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.