The CSRD: an opportunity to build a robust environmental strategy

The European Union is stepping up its efforts on environmental reporting with its new Corporate Sustainability Reporting Directive (CSRD). Adopted at the end of 2022, this demanding regulation will come into force in 2024, with the first reporting due at the beginning of 2025 for concerned companies, as we mentioned in our first article on the subject.

In this article, Carbone 4 takes a closer look at the regulation, to help you make sense of it and understand the benefits of following the CSRD. In particular

- What is the CSRD?

- What does the CSRD require? Particularly when it comes to the climate!

- What do companies need to do to prepare? What's in it for them?

While many companies haven’t waited for regulations to come into force to communicate on their environmental strategy, this new legal obligation will make reporting an unavoidable requirement.

Background: What is the CSRD? Why does it exist?

The CSRD requires companies to share information on their risks, opportunities and impacts on various environmental (climate, biodiversity, water, etc.) and social (employees, workers in the value chain) issues.

Compared with previous regulations [1], the CSRD concerns a larger number of companies, and requires more detailed and comprehensive reporting: it specifies precise information and indicators to be disclosed, on a larger number of subjects.

The first objective of the CSRD is to help external stakeholders (notably investors, but also customers and the general public) gain a clearer understanding of the risks faced by companies, and to compare companies with each other in terms of their vulnerability and readiness for the transition. This information enables investors to protect themselves against the risk of "stranded assets".

The CSRD also aims to create a more environmentally-virtuous economy. By requesting information on the environmental impact of companies, the regulation aims to create favorable conditions for good performers (i.e. companies that are less emissive and more compatible with a low-carbon world - or prepared to be). It should, in reverse, complicate conditions for low performers, for example through more costly access to capital or debt.

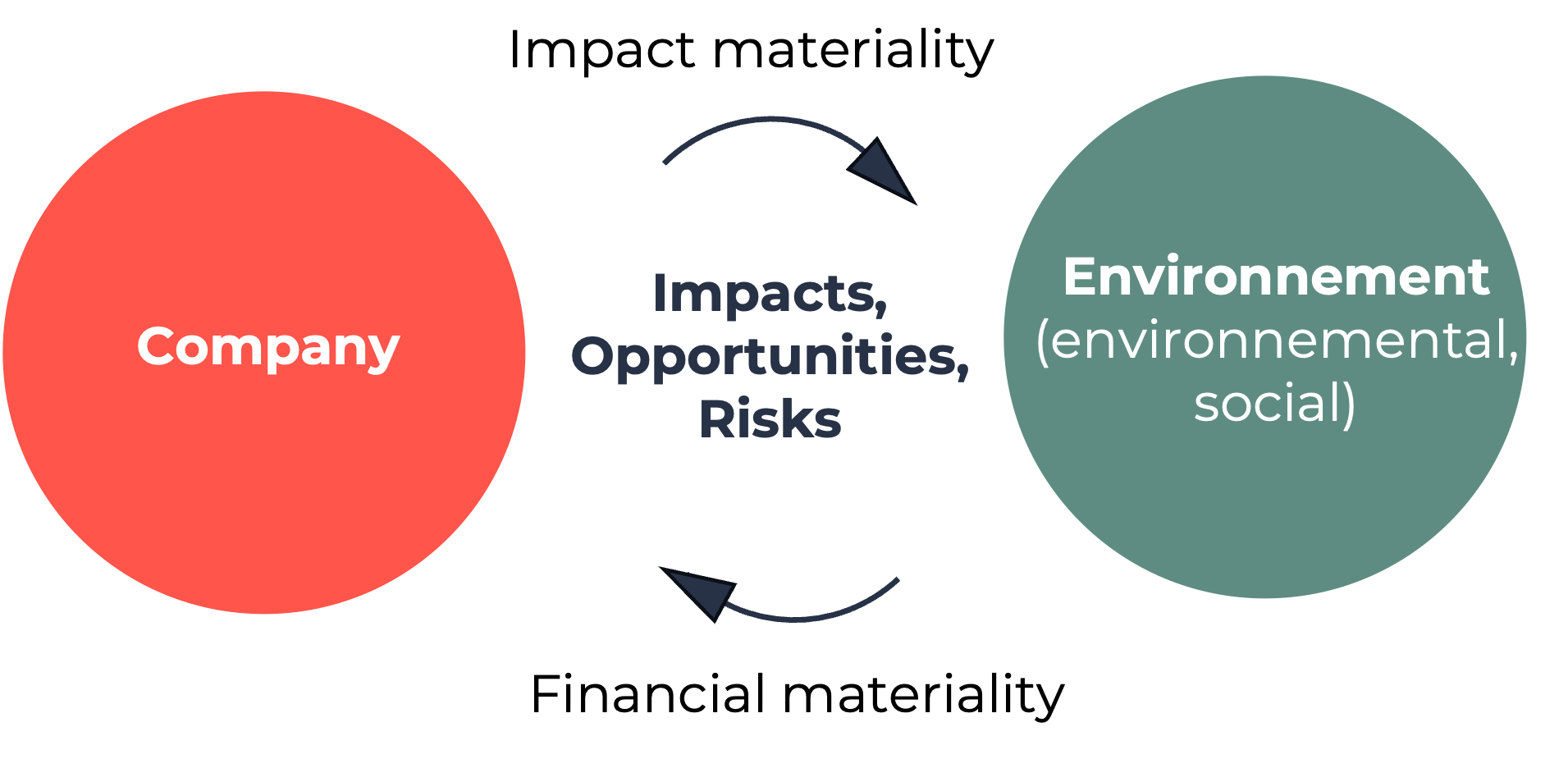

In simple terms, the CSRD uses a double materiality approach to :

- understand the company's impact on planetary limits (e.g. climate, biodiversity, water) and social issues;

- understand and "monetize" the impact of ecological upheavals on the economic sustainability of companies.

Another major benefit of CSRD is that it enables companies to better understand their risks and opportunities with regard to environmental and social issues, and thus better prepare for them.

What does the CSRD require? In general and on climate

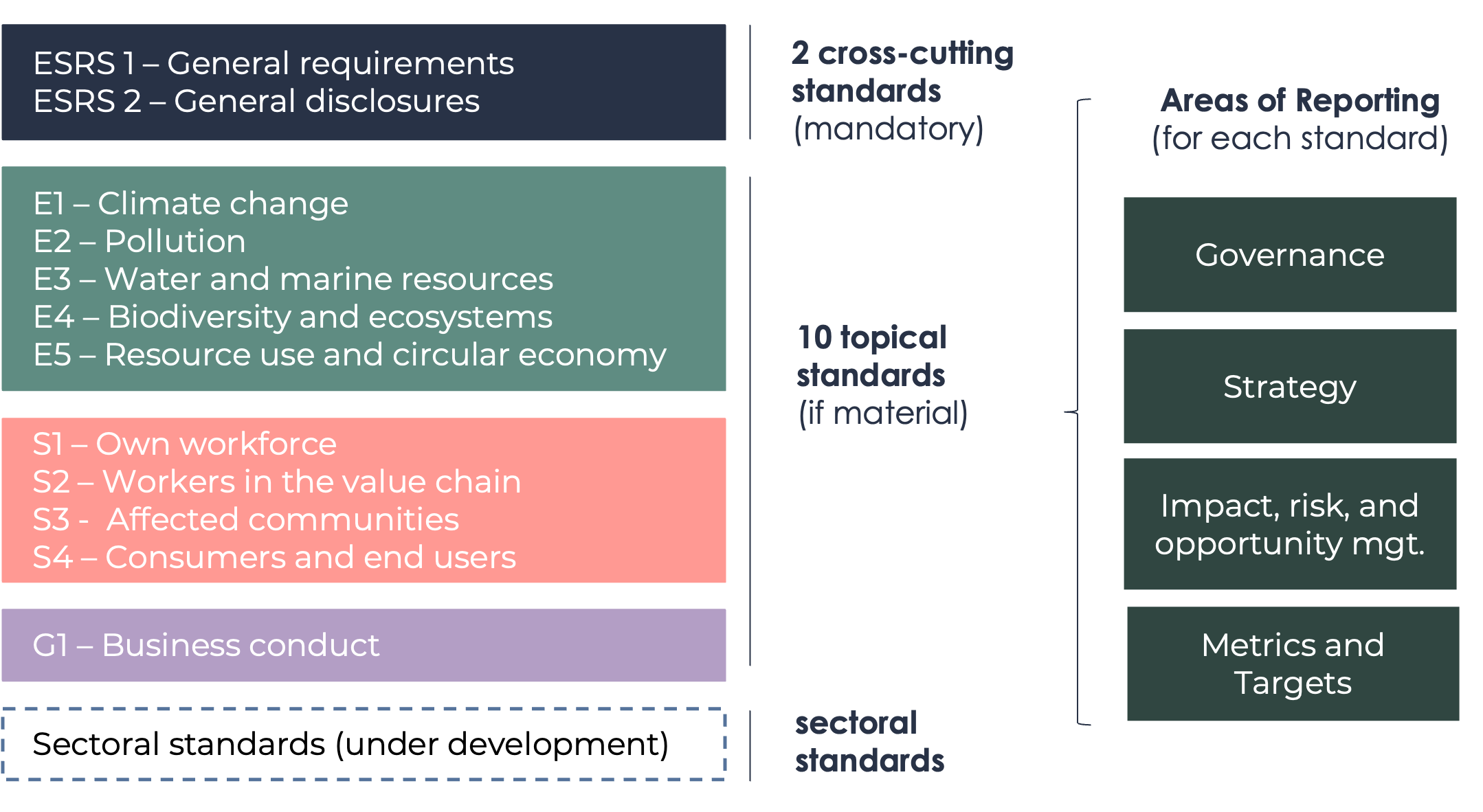

The CSRD is comprised of 12 standards: the ESRS (European Sustainability Reporting Standard)[2]. These include :

- 2 transversal standards (mandatory)

- 10 thematic standards on various sustainability topics (conditionally mandatory)

- sector-specific standards (to come)

All companies subject to the CSRD must report on the two mandatory cross-functional topics, and must identify which of the 10 thematic topics they are concerned with. To do this, companies are asked to identify the double materiality of each of the 10 topics on their business: i.e. whether they have an impact on the topic, and/or whether it is likely to have a financial impact on the company. It should be noted that, for the climate topic, companies must justify their finding of non-materiality.

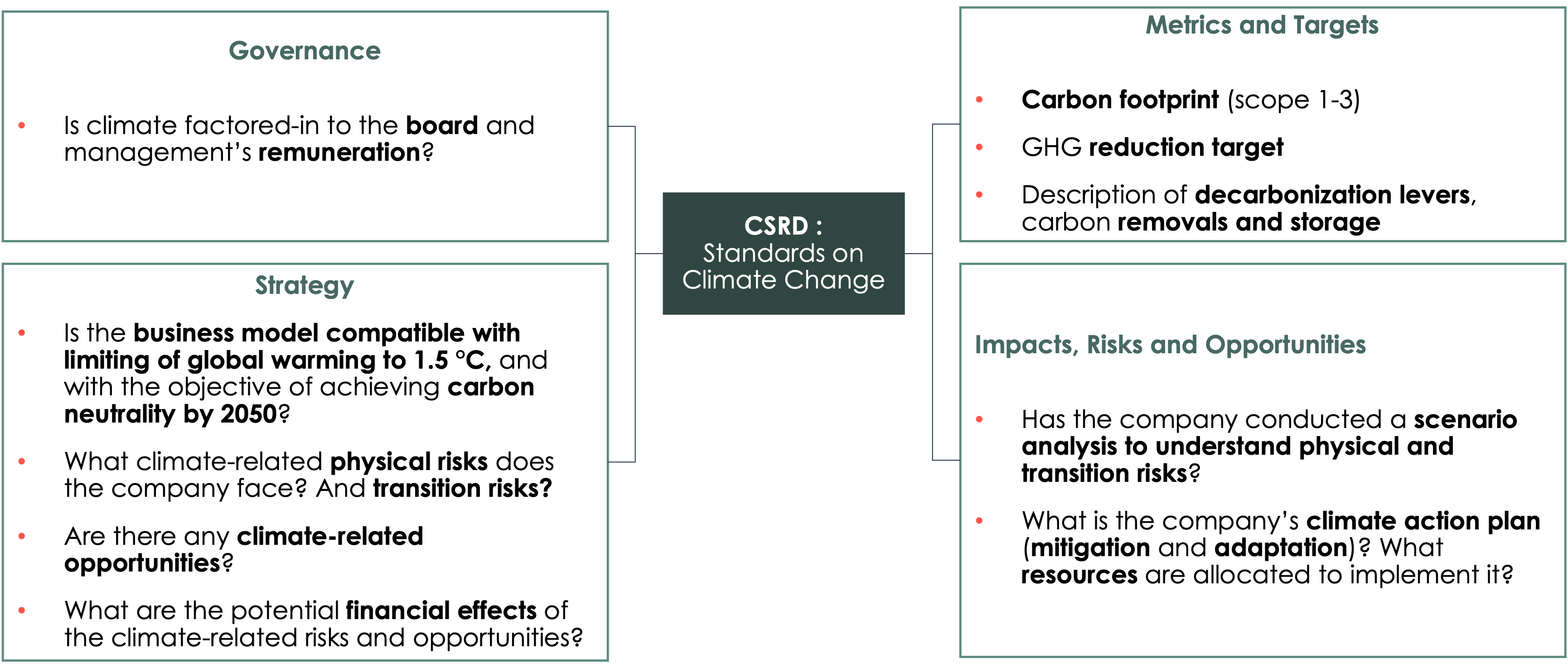

If we zoom in on the climate topic, the CSRD asks companies to understand and report on their governance, strategy, risks and opportunities, and metrics in the face of climate change. These rigorous demands are an opportunity for any economic player to ask themselves vital questions. What is the company’s relevance and likelihood of durability in a world already facing the physical impacts of climate change; and within a society seeking to rapidly mitigate its environmental impact to maintain a habitable world.

An overview of the important information requested by the CSRD on climate is presented below.

The content of the CSRD is largely inspired by the philosophy of the TCFD [3] and incorporates best practices for defining a climate strategy, on which Carbone 4 has relied for many years to support its corporate clients. Europe has sought to harmonize reporting requirements to a large extent with existing standards, including the TCFD but also the ISSB [4]. The main difference lies not in content, but in the dual materiality approach: the ISSB recommends an analysis of simple materiality (i.e., financial materiality).

How to prepare?

To respond to the CSRD on climate, companies need to :

- Better understand their current impact and dependence on greenhouse gas emissions, by carrying out a carbon footprint,

- Understand how to adapt their business model for a low-carbon world, by projecting themselves into trajectories that limit temperature rise to 2°C, and

- Identify their physical risks and adaptation needs in the face of current and future climate change.

While the CSRD requires transparency, and guides reflection on the definition of a climate strategy, the relevance, ambition and success of this strategy depends heavily on the level of engagement within the company. Responding to the CSRD is therefore not just another extra-financial reporting gesture, but an opportunity to re-define one's strategy in the face of climate change, rallying management teams, in-house climate experts, as well as operational teams trained on these issues.

The CSRD can therefore be seen either as an additional constraint for economic players (and therefore an additional transition risk), or as a fantastic tool to improve the relevance of their corporate strategy and make it compatible with a low-carbon world.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.