Towards climate integration into global prudential banking regulation

The Basel Committee on Banking Supervision, is the primary global standard setter for the prudential regulation of banks. It has 45 members comprising central banks and bank supervisors from 28 jurisdictions. Its mandate is to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability. It has been the developer of the Basel Accords, a widely applied framework for the regulation, supervision and risk management of banks.

The Basel Committee made one step further in its strategy to integrate climate-related financial risks in the prudential framework for banking regulation.

On April 14th 2021, The Basel Committee released two reports on climate-related financial risks: on the transmission channels [1] between (i) climate physical and transition risks and (ii) traditional financial risk categories; and on measurement methodologies [2], outlining the need for improved climate data and methodologies, naming the Climate Risk Impact Screening methodology [3], developed in 2017 by Carbon4 Finance.

Climate change is an existential threat posing major risks to our economies. The Basel Accords and their implementation are key elements of the financial system stability, requiring banks to maintain capital buffers against the risk they take. We thus welcome this step forward by the Basel Committee, as banks are still lacking data and methodologies to properly integrate climate change in their risk management framework.

The Basel Committee has developed a strategy on prudential climate change integration.

On February 2020, the Basel Committee on Banking Supervision announced the set up of a high-level Task Force on Climate-related Financial Risks (TFCR) with the mandate of enhancing global financial stability through the following initiatives:

- A stocktake on members’ existing regulatory and supervisory initiatives on climate-related financial risks,

- A set of analytical reports on transmission channels and measurements methodologies for climate-related financial risks,

- The development of supervisory practices in order to mitigate climate-related financial risks.

The results of the stocktake [4] on existing initiatives has been published on April 2020. The two reports on transmission channels and measurements methodologies have been published on April 14th, 2021. We will expect Basel Committee members to build upon the results of these reports and market reactions to develop supervisory practices integrating climate related financial risks into prudential banking regulation.

Basel Committee members would like to integrate climate change; but data, methodologies and understanding are lacking.

In the April 2020 stocktake of existing initiatives, the Basel Committee looks at the way in which climate-related financial risks are integrated by its members: among which the European Central Bank, the European Banking Authority, national central banks and financial markets regulatory and supervisory bodies.

It notes that the members "consider it appropriate to address climate-related financial risks within their existing regulatory and supervisory frameworks” and that research has been conducted to determine how this can be achieved. However, operational hurdles remain such as data availability, methodological challenges, and difficulties in mapping transmission channels.

Key challenges identified by Basel Committee (number of votes)

Source: Basel Committee

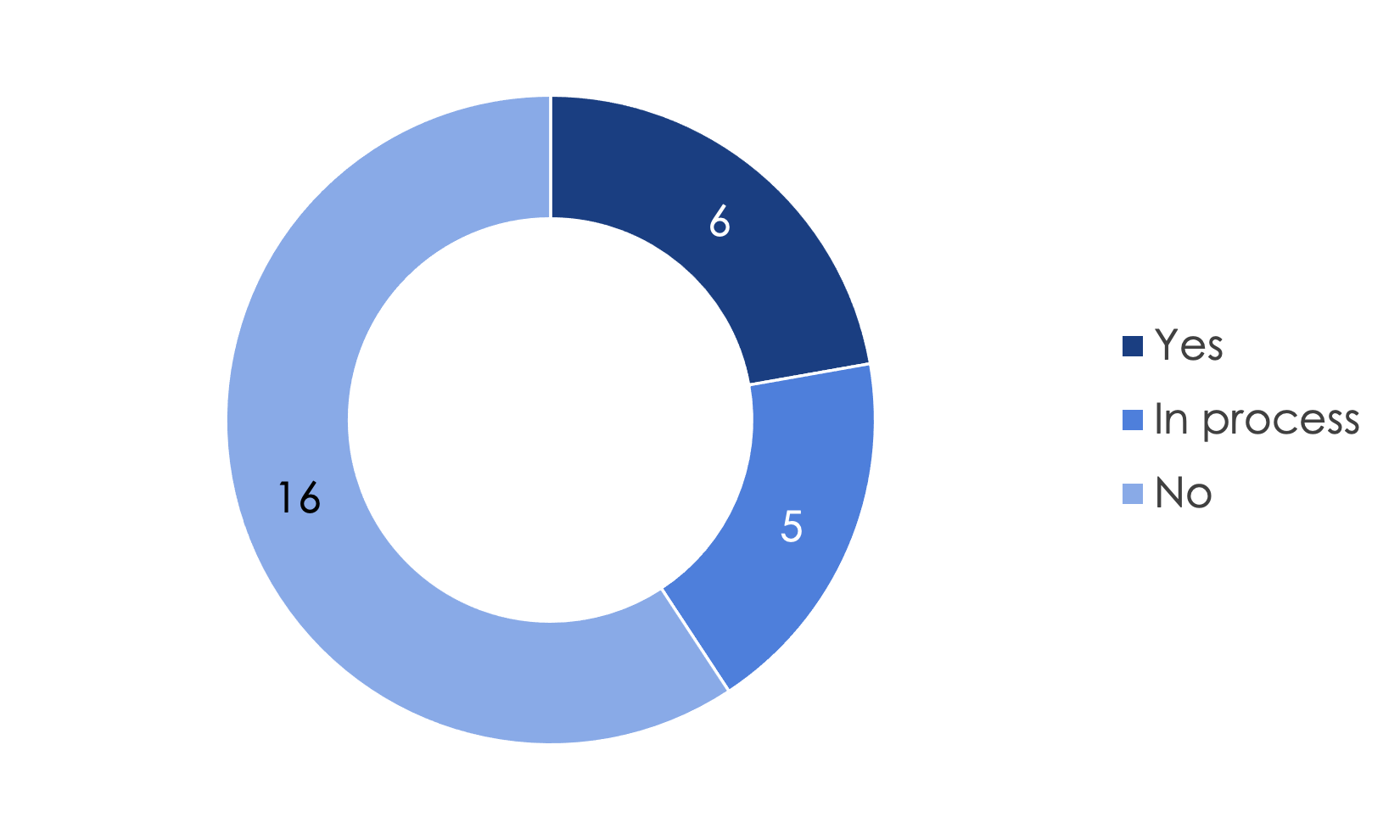

3 responding members out of 5 had not integrated climate-related financial risks into their prudential capital framework.

Number of respondents who have issued supervisory guidance on climate-related financial risks

Source: Basel Committee

The April 2021 publication of two analytical reports precises what needs to be done and which type of data and methodologies is needed.

Transmission channels

The report outlines how the banking system is exposed to climate change through micro and macro economic transmission channels that arise from two distinct types of climate risk drivers: physical risks and transition risks.

Financial risks from climate risk drivers

Source: https://www.bis.org/bcbs/publ/d517.pdf (p4)

Traditional banking risk categories (Credit, Market, Liquidity and Operational risk) can then be used to assess climate-related financial risks impacts on banks and the banking system stability. This mapping of transmission channels from climate risk drivers to traditional risk categories will allow climate risk integration into the existing prudential rules without the need to completely overhaul the existing framework.

Source: https://www.bis.org/bcbs/publ/d517.pdf

Measurement methodologies

To date, measurement of climate-related financial risks by banks and supervisors have focussed on short-term transition risks, with a dominant use of the carbon footprint/carbon intensity and sectoral exposure such as coal sectoral exposure.

The report outlines the need for granular, bottom-up and forward looking data and methodologies. High granularity of exposure data may as well be necessary, both in terms of geolocational data and counterparty- and industry-level data.

New and unique type of data will be needed, spanning across three areas:

- data translating climate risk drivers into economic risk factors,

- data linking climate-adjusted economic risk factors to exposures,

- and data to translate climate-adjusted economic risk into financial risk.

The report evaluates candidate methodologies for estimating climate-related financial risks. It describes that conventional risk measurements approaches can be adapted to assess climate risks but “[in] practice, […] the range of impact uncertainties, time horizon inconsistencies, and limitations in the availability of historical data on the relationship of climate to traditional financial risks, in addition to a limited ability of the past to act as a guide for future developments, render climate risk measurement complex and its outputs less reliable as risk estimators”.

Among those risk measurement processes, the report highlights the most prominent and conventional practices: climate risk scores and ratings, scenario analysis, stress testing and sensitivity analysis.

Climate risk scores aim to assess the relative climate exposure of existing and prospective credit intermediation. Among the measurement processes identified, the Basel Committee report outlines the Climate Risk Impact Screening methodology, developed in 2017 by Carbon4 Finance, noting that “Climate risk rating methodologies [are] often developed with highly granular data, enabling them to be location-specific, and incorporate supply chain and company-specific information”.

We note that the French central bank (Banque de France) has also built on the data provided by Carbon4 Finance to assess the climate change-related transition risks associated with its collateral portfolio [5].

The report concludes with the need for investments to address methodological and data gaps, which will foster improved prudential management and mitigation of climate-related financial risks.

Futur developments in global prudential regulation

The next objective for the Basel Committee and its Task Force on Climate-related Financial Risks is to develop climate-related financial risk supervisory practices. These practices will be ultimately translated into banking regulation, building on improved climate data and methodologies.

As a pioneer in the development of bottom-up and forward-looking climate data and methodologies, Carbone 4 welcomes the issuance of these two analytical reports clearly paving the way for climate-integrated global prudential regulation standards.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.