Is it true that 90% of carbon credits are worthless?

A nine-month joint investigation by journalists from The Guardian, Die Welt and SourceMaterial has shown that 90% of the REDD+ carbon credits from the world's largest offsetting standard actually have no positive impact on the climate.

The team based its findings on three recent scientific publications analyzing Verra's credits, as well as on a dozen interviews with climate scientists, insiders of the voluntary carbon market, and project developers.

The result of the investigation is clear: Verra's REDD+ credits, whose goal is to provide private funds to protect rainforests in sensitive areas, seem to have truly avoided deforestation only in a very limited number of cases. 94% of the credits are reported to have had no effect on the fight against climate change.

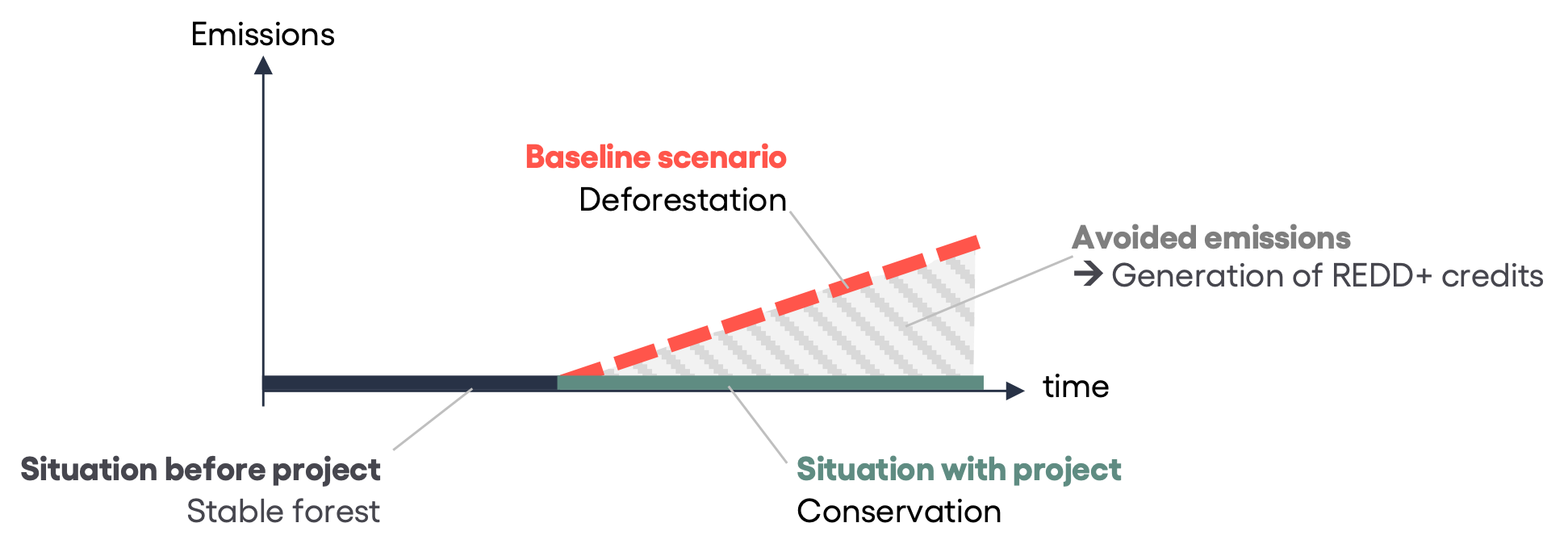

Why such a gap between Verra's predictions and reality? First of all, it is important to understand that REDD+ carbon credits are issued in proportion to the amount of deforestation avoided, i.e. the difference between the situation where the forest is protected and an alternative situation, called the "reference scenario", which would have taken place in the absence of protection. Credits are then generated based on the amount of carbon that was not emitted into the atmosphere as a result of funding the conservation program.

However, it appears that these baseline scenarios exaggerated the threat of deforestation in the areas under consideration, which had the effect of overestimating the positive effect of the projects. One of the three studies amounts this overestimation to +400%, and even +950% if three particularly successful projects in Madagascar are excluded from the calculation.

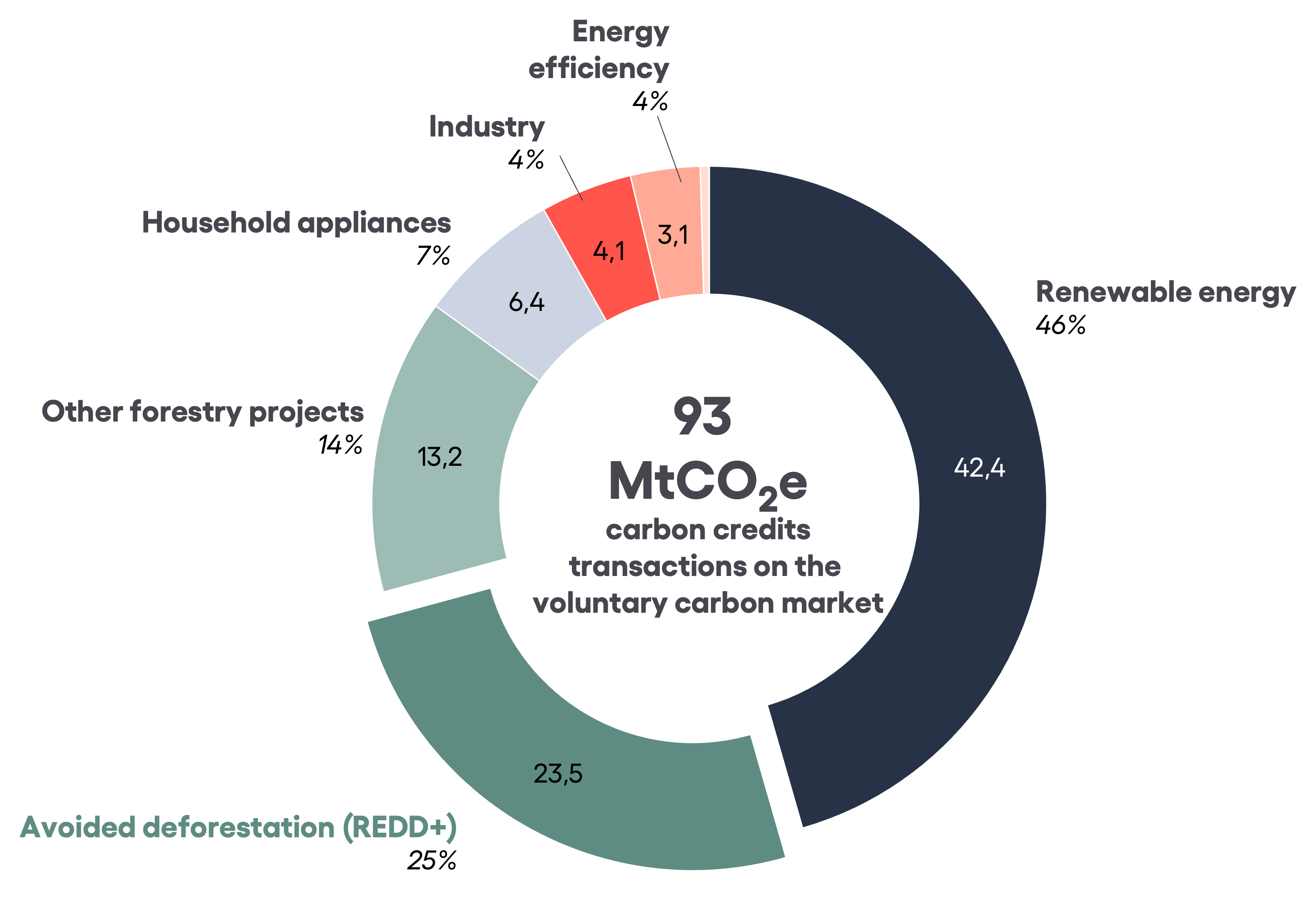

Verra certifies three quarters of all carbon credits on the planet, and has issued more than one billion credits since its creation. Its rainforest protection program, the one targeted by the Guardian investigation, accounts for 40% of its credits. It is worth noting that carbon credits are the key element of the "carbon neutrality" claims used by a large number of companies, either for their products and services or for their own corporate activities. Sometimes, these carbon credits are even directly counted as a direct reduction of their carbon footprint, which is prohibited by international climate accounting standards.

In addition to the fact that the notion of "neutrality" at such small scales poses strong conceptual problems, the Guardian's study reminds us that it is the very system for calculating and generating carbon credits that is undermined by methodological problems.

A rigorous investigation that reveals a systematic overestimation of climate gains

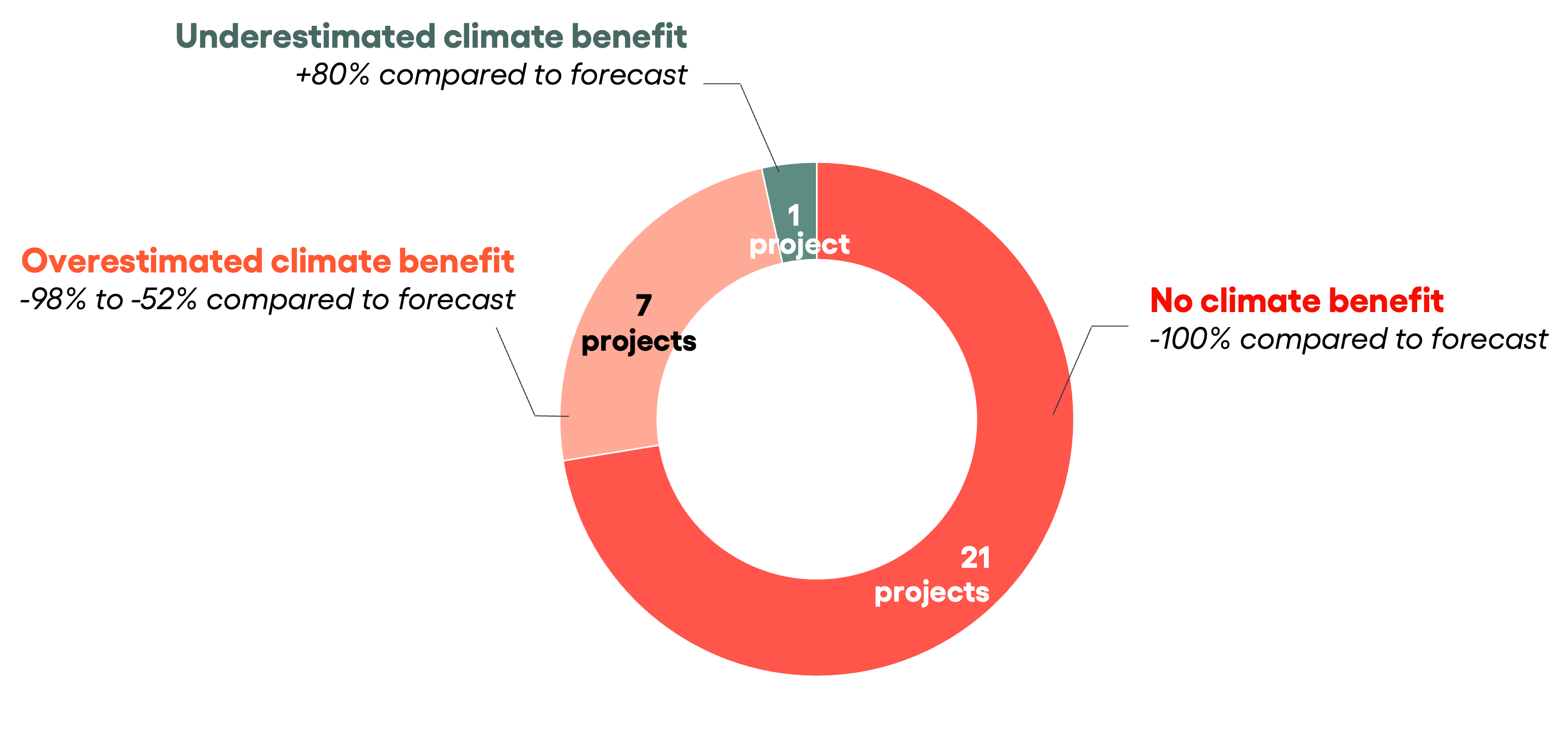

The investigation was based on three research papers. Two of them (here and here, as a preprint) were produced by the same international team, the third by a team from Cambridge University. The work focuses on the analysis of 87 preservation projects certified by the Verra standard. Among the 29 projects for which the data was usable, only 8 had a real impact on the climate. Among these, only one had an effect equal to or greater than what was originally calculated by Verra.

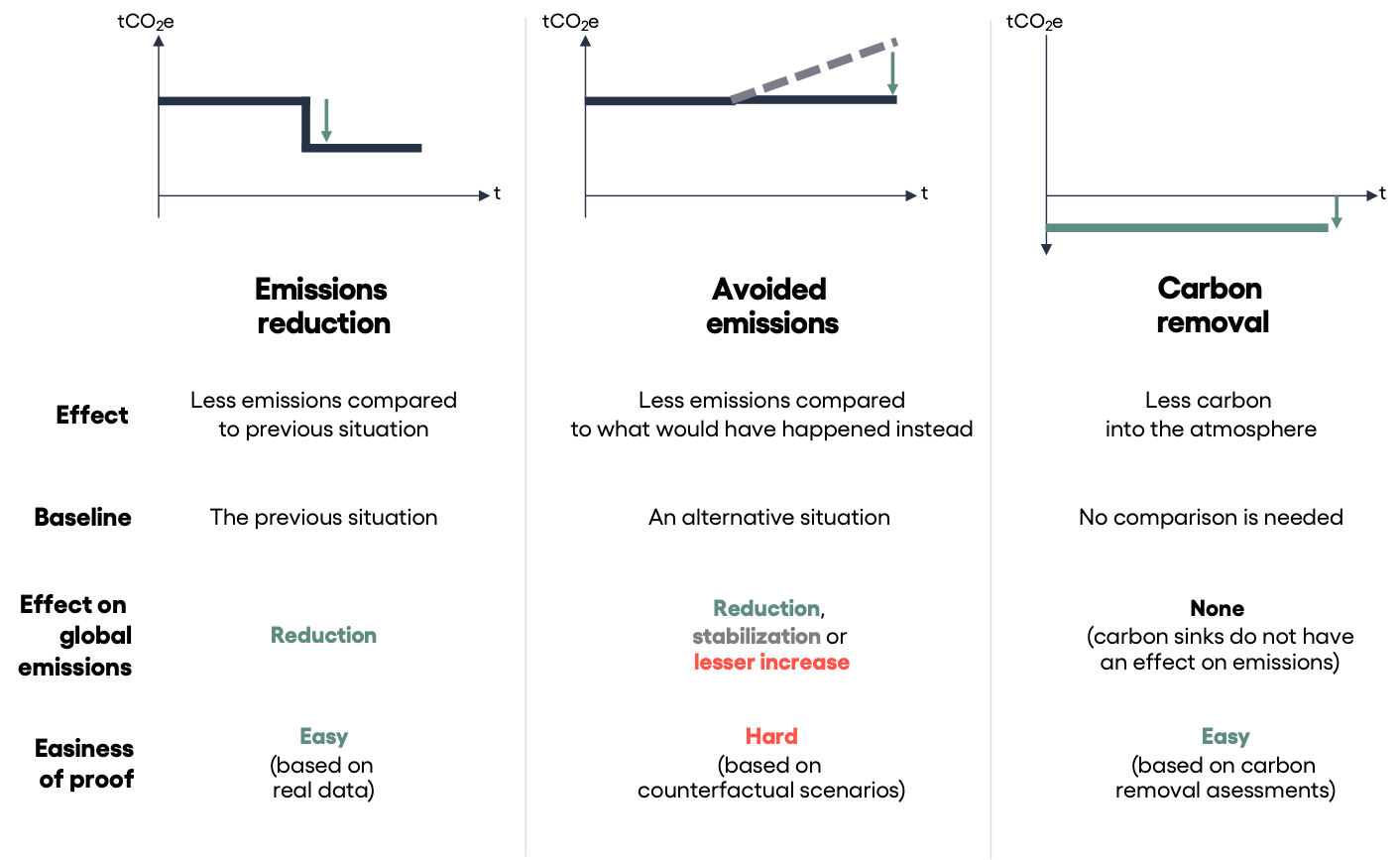

It should be noted that the construction of a baseline scenario is a difficult exercise, since it is an estimate, by construction unverifiable, of what would have happened in the absence of the implementation of a project. The art of constructing a robust baseline scenario consists in imagining a future that is as plausible as possible; it is therefore an infinitely more complex exercise than a simple measure of emissions reduction over time, or a measure of carbon removal.

Nevertheless, despite the uncertainty of this measure, the three research papers on which the Guardian's investigation is based independently show that Verra appears to have systematically overestimated the effectiveness of the projects analyzed. This result confirms the criticisms made of the voluntary carbon market over the past two decades.

At a time when powerful forces are moving to massively expand the voluntary carbon market, it is urgent to :

- correct the methodologies for certifying carbon projects as quickly as possible, so as to put private finance at the service of truly additional and climate-efficient projects. Otherwise, we will collectively lose precious time and money. The structural flaws of the voluntary market have unfortunately been known for the past twenty years; this discovery of the anomalies of Verra's REDD+ methodologies raises serious questions about the ability to one day "fix" this market, which some are already calling for to be abandoned

- to recall, as often as necessary, that a company has no right to count its carbon credits as emission reductions, as Carbone 4, Net Zero Initiative, ADEME, SBTi, GHG Protocol, ISO, and a host of other benchmarks have repeatedly pointed out. Only real scope 1, 2 and 3 emissions reductions can be counted as progress towards reduction targets.

There is no doubt that the voluntary carbon market is playing a dangerous game. While it is necessary to mobilize private finance to fight deforestation, the beneficial effects of such financing should not be overestimated, nor should it be assumed that a company can choose to activate offsetting or decarbonization of its activities as two interchangeable levers.

The Net Zero Initiative, Carbone 4’s framework on the contribution of companies to global net zero emissions, has always considered the purchase of carbon credits to be a complementary action that must be distinguished from the efforts that the company must make to transform its business model and make it compatible with the Paris Agreement. NZI also recommends strictly separating "reduction", "avoidance" and "removal" credits. This approach to climate action by private actors does not solve all the structural problems of the carbon market, but it does have the merit of establishing safeguards in the development of corporate climate strategies at a time when any delay in climate action could prove fatal.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.