From +3°C to below 2°C: proof that climate action works for infra funds

From +3°C to below 2°C: proof that climate action works for infra funds

Whilst new infrastructure financing comes online, like Germany’s €500 billion special fund for infrastructure and climate neutrality, the climate is not being left behind !

It’s not too late for the climate.

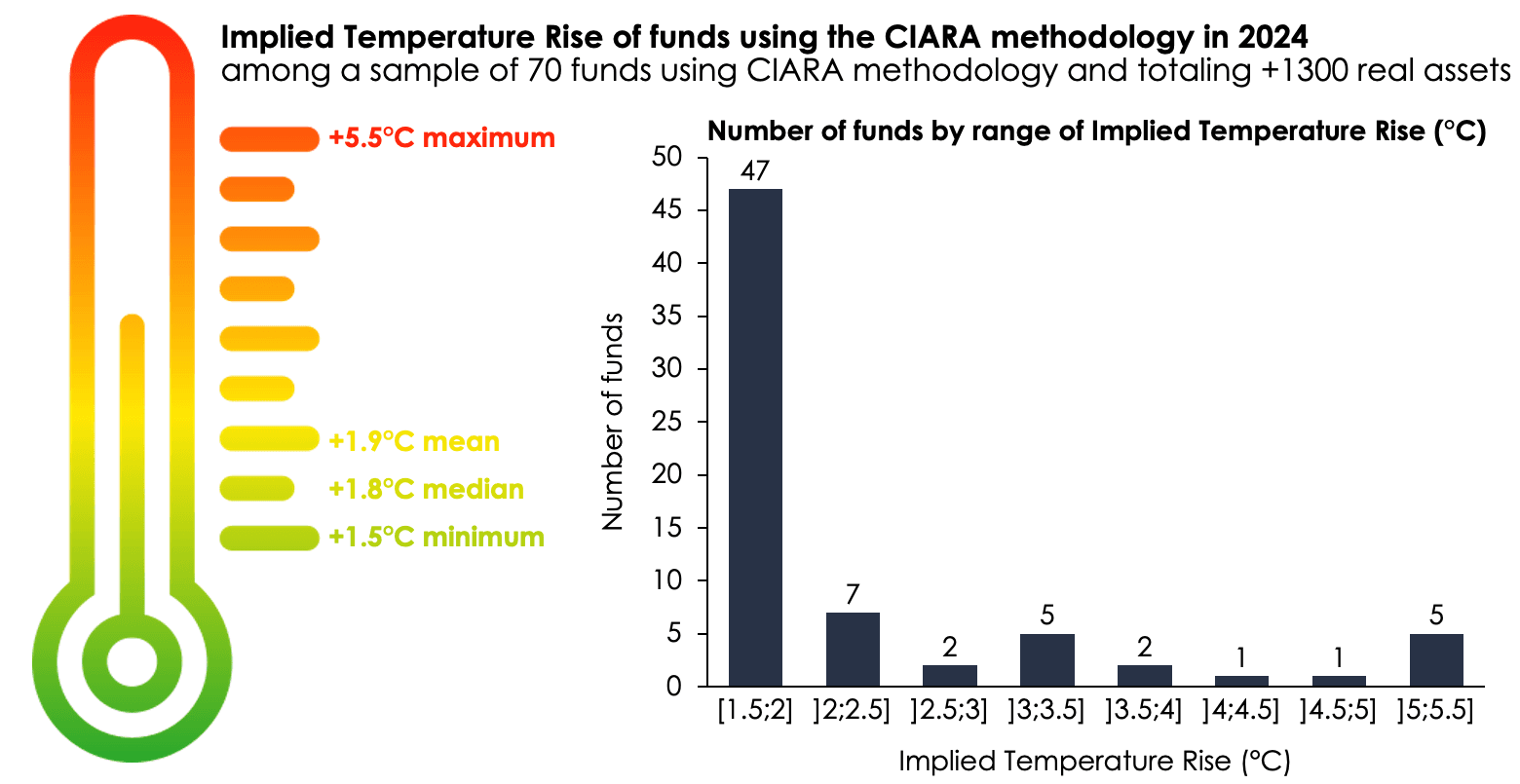

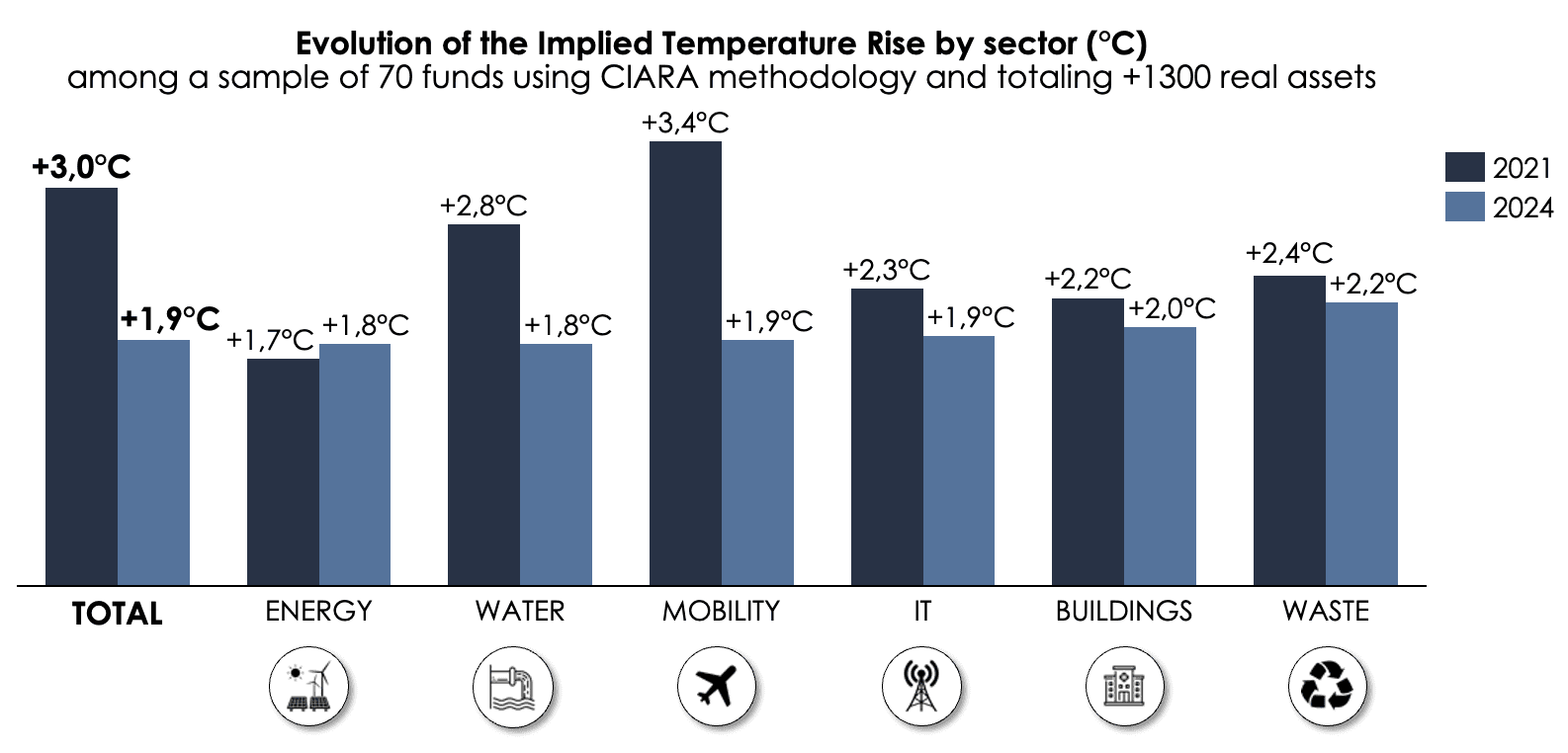

From 2021 to 2024, Carbone 4 analyzed 70 funds totalling +1300 real assets, and found that the infrastructure investors improved the average Implied Temperature Rise of their portfolios over that period from +3°C above pre-industrial levels in 2021 to just +1.9°C in 2024. Two thirds of these funds are now aligned with a +2°C scenario, the upper limit of the Paris Agreement. 85% of these funds have an Implied Temperature Rise below the current policies scenario[1] of +3.6°C. Our analysis includes real assets from 4 regions (Europe, North America, Africa, the Mediterranean), over 6 sectors (Buildings, Energy, IT, Mobility, Waste, Water), financed via debt and equity representing 50 billion USD of AUM (Assets under Management).

Track Right, Act Smarter

What do these funds have in common? Their investors have all used Carbone 4’s innovative methodology Climate Impact Analytics for Real Assets (CIARA) over the past 4 years to track climate metrics, make investment decisions, and focus their decarbonization efforts where it matters.

Best-performing investors have even gone beyond reporting, leveraging the true power of climate insights and metrics. If there were a “recipe” for a Paris Agreement Aligned Portfolio, one could say that the key 3 ingredients are : targets, due diligence and engagement and the measuring cup for these ingredients is climate data via CIARA.

The Big Three

Targets: Paris-aligned climate investors have set strong climate objectives for their funds, e.g. below 2°C Implied Temperature Rise, >50% EU-Taxonomy alignment. They managed to monitor progress against these objectives by integrating data in decision-making.

Due Diligence: Climate investors systematically include a temperature assessment into their Climate Due Diligence to help the decision-making process

Engagement: To improve energy efficiency and carbon intensity of assets, investors prioritize shareholder engagement and support of their real assets throughout the fund lifecycle.

At a more granular level, by sector, all but one of the 6 sectors improved their average Implied Temperature Rise (ITR). Below is the breakdown by sector, in order of most aligned to least aligned with a +2°C scenario in 2024:

- Energy: Whilst being the most aligned sector, there was a slight deterioration of its ITR of +0.1°C from 2021 to 2024. This is due to an increase in investment and financing of natural gas assets, potentially related to the Ukrainian-Russian crisis, which started in 2022 and limited the natural gas procurement from Russia. Still with this slight increase in Implied Temperature Rise, the energy assets here demonstrate the best climate performance of all the 6 sectors with an overall Implied Temperature Rise of +1.9°C in 2024. This climate performance is driven by significant investments and financing in renewable energy assets.

- Water: Financed assets in the water sector made a dramatic improvement between 2021 and 2024 (-1°C). This sector is now Paris-aligned (<2°C). This improvement is driven by the energy efficiency improvement of water assets through retrofit.

- Mobility: Financed assets in the transport sector also made a significant improvement between 2021 and 2024 (-0.5°C). This sector is now Paris-aligned (<2°C). This improvement relates to an increase in investment and financing of public transport assets (bus, metro, railway, tramway) as well as electrification assets (charging stations).

- IT: Financed assets in the digital sector also made a significant improvement between 2021 and 2024 (-0.4°C). This sector is now Paris-aligned (<2°C). This improvement is driven by the increase in investment and financing of fixed network assets (like fiber-optic broadband to homes and businesses) instead of mobile network assets (like 4G/5G). While they address different constraints (high-throughput versus mobility & flexibility), fixed networks are much more energy efficient than mobile networks to transmit data. The difference in energy efficiency comes notably from the fact that data travels in one way directly through cables for fixed networks compared to three ways for wireless signals of mobile networks.

- Buildings: Financed assets in the tertiary sector improved between 2021 and 2024 (-0.2°C). This improvement relates to the energy efficiency improvement of building assets driven by regulation: brownfield buildings are renovated and greenfield buildings are subject to stringent carbon intensity thresholds to obtain building permits, e.g. the RE2020 law in France with an effective date in 2022.

- Waste: Financed assets in the waste sector improved between 2021 and 2024 (-0.2°C). This improvement occurred thanks to the increase in investment and financing of sort-out plants supporting the development of the recycling value chain.

Our teams have developed a concise guide to share with infrastructure managers a few key insights to help them move forward in their decarbonation journey.

To know more about CIARA

- Contact: ciara@carbone4.com

- Website: https://ciara.carbone4.com/

- Methodological guide: https://www.carbone4.com/guide-ciara-attenuation-changement-climatique