Liquefied natural gas : after the emergency improvisation, let's come to our senses

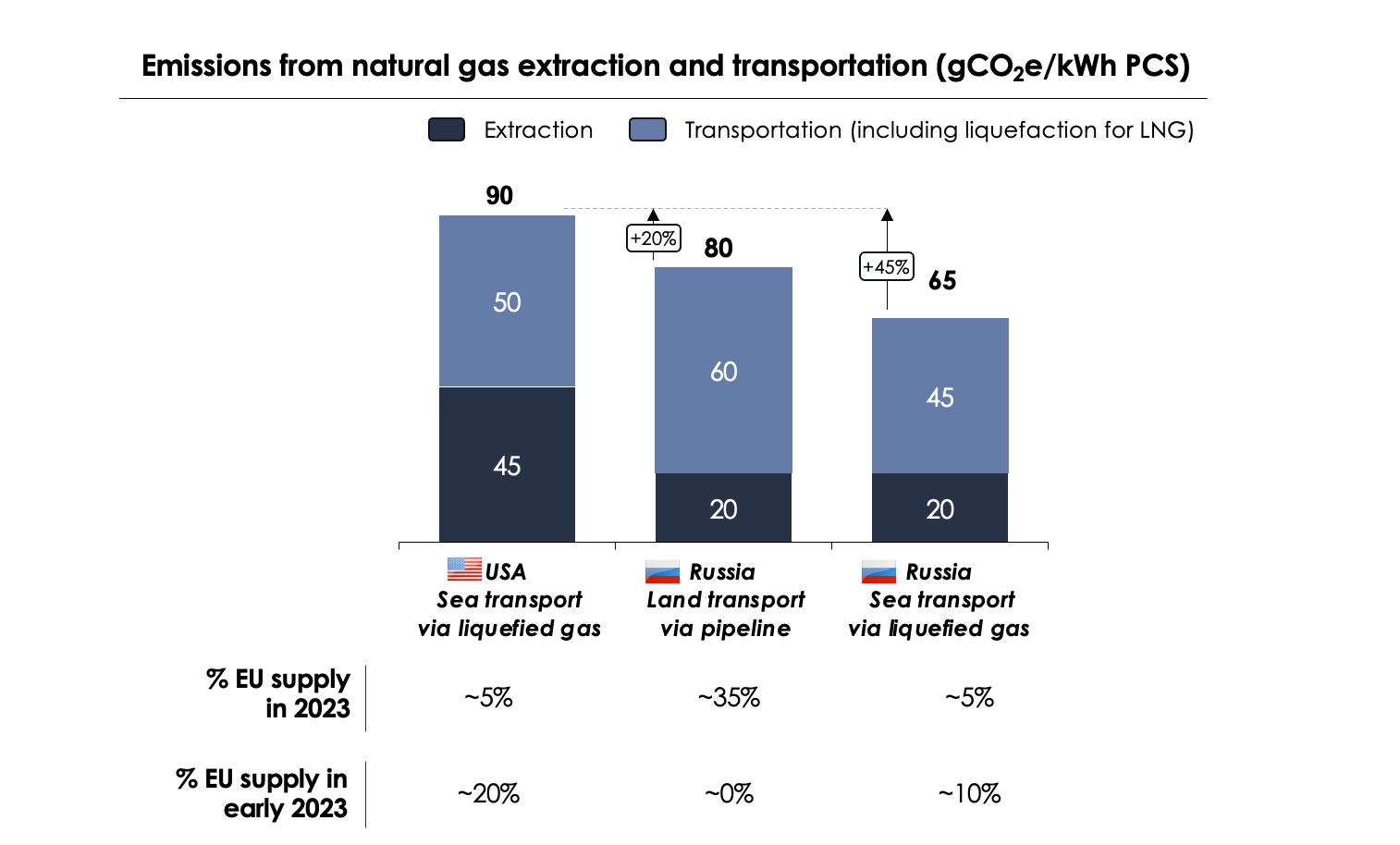

The war in Ukraine has turned European natural gas supplies upside down. The old continent has moved from Russian to American dependence. Indeed, the share of American gas in the European mix has risen from around 5% in 2021 to 20% in early 2023[1], while the share of Russian gas has fallen from 40% to 10% over the same period.

The primary objective was obviously to secure our country's energy supply, but at what cost?

An american gas very harmful to climate change

Firstly, it is essentially made up of shale gas, the exploitation of which has been banned in France since 2011. Without even mentioning the local pollution generated by hydraulic fracturing, extracting shale gas emits 2 to 3 times more greenhouse gases than extracting conventional gas. The reason? It requires more energy (horizontal drilling, hydraulic fracturing) and generates more methane leaks (since initialization takes longer, more gas needs to be processed to stabilize production).[2]

Secondly, it has to be liquefied and transported by ship over long distances to reach Europe. Around 10% of energy is lost at the liquefaction stage, and keeping methane in a liquid state over tens of thousands of kilometers induce energy consumption and, above all, methane emissions.[3]

On the other hand, Russia's gas pipeline network is often criticized for its obsolescence, and the leaks it may cause. Nevertheless, we should bear in mind that the majority of Russian gas arrives in France in liquefied form: 70% by 2020, 100% today.

The result: American gas emits 20% to 45% more greenhouse gases than Russian gas in terms of upstream emissions. As a reminder, downstream combustion emissions are of the order of 190 gCO2e/kWh.[4] Even so, on the scale of the French territory, the impact is 1 to 2 MtCO2e. This is equivalent to wiping out the climate benefits of the equivalent of 10 TWh of biomethane, whereas in 2022, only 7 TWh of biomethane will be injected into the French grid.

A lot of money spent unnecessarily?

Liquefied natural gas (LNG) terminal projects have sprung up all over Europe, particularly in Germany, at a cost currently estimated at 7 billion euros.[5] However, the majority of LNG terminals may not actually be needed at all.[6]

The analysis of the think tank IEEFA (Institute for Energy Economics and Financial Analysis) is quite clear.[7] European demand for LNG could reach between 150 and 190 billion m3 by 2030, while cumulative LNG terminal capacity could be close to 400 billion m3.

What will become of these investments, most of which are publicly funded? Is it just another excuse to delay action on climate change, as these infrastructure will have to pay for themselves?

The false feeling of having escaped the worst during the winter of 2022-2023

In March 2022, the price of natural gas in Europe reached an all-time high of €345/MWh. Since then, tensions have eased: the winter of 2022-2023 passed without any disruption to energy supplies, and the price of gas fell back to €40-50/MWh in the first half of 2023. It should be remembered, however, that the price hovered around €20/MWh before May 2021.[8] It is now the LNG market that sets the price, not the Russian pipeline market.

Is the worst behind us?

On the face of it, no, because last winter was a very special one. Europe stored Russian gas throughout the first half of 2022 before the tap was turned off. Moreover, China was confined and therefore set a low pressure on global LNG demand.

The Shift Project's analysis[9] shows that without a drastic reduction in our gas consumption this year, we are very likely to experience very high prices again next winter. Indeed, by 2025, European demand will only be contractually covered up to 60%. In other words, to make up the difference, we'll have to improvise on the wholesale market, where available quantities will not be unlimited. At the same time, biomethane production will increase, but not enough to fill the gap.

Moving away from fossil gas as quickly as possible

Let's get ahead of the curve, before we suffer from the climate crisis, the economic losses of stranded assets or our energy dependency.

Today, gas is consumed 50% in our buildings, 25% in industry and 20% in the production of electricity and heat.[10] And there is no shortage of solutions for reducing our fossil gas consumption:

- Replacing gas-fired boilers in buildings with heat pumps, geothermal energy, solar heating and low-carbon heating networks. Preserving our renewable gas for uses that are difficult to decarbonize: high-temperature heating, heavy mobility, power flexibility.

- Massive insulation of buildings. In the residential sector, we have yet to achieve 100,000 high-performance renovations by 2022, whereas we need more than 700,000 every year until 2050.[11]

- Deploying structural sobriety to consume less direct energy at home and less indirect energy in products manufactured by industry. A useful lever for all energies and all sectors.

We mentioned this back in March 2020. Consuming less energy is the best weapon for doing without Russian gas in record time.[12] And the good news is that saving energy means a more balanced trade balance, greater geopolitical independence, more local jobs and a more controlled energy bill. So, what are we waiting for?

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.