Increase the accuracy of carbon footprint for Li-ion battery

A mandatory step to structure a low-carbon supply chain in Europe (and elsewhere)

Executive summary

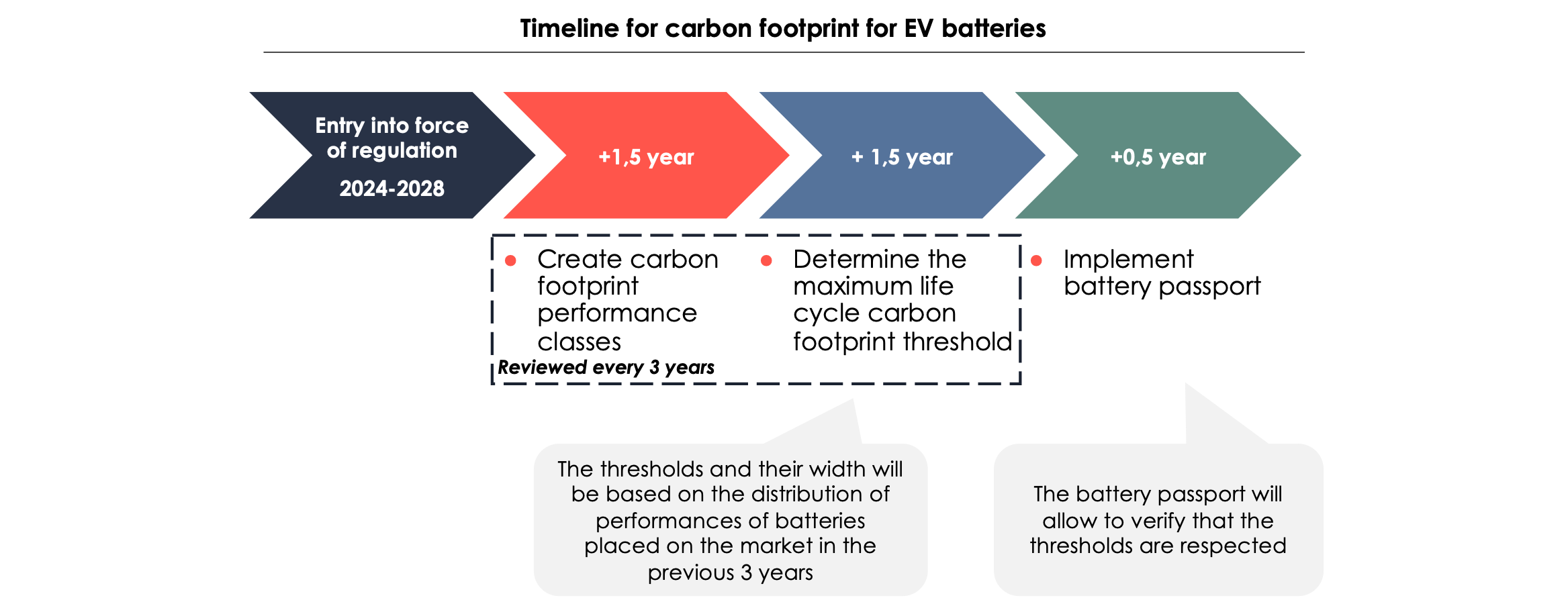

- Europe aims to develop a European low-carbon industry for Li-ion batteries, especially for mobility purposes. To achieve this objective, the regulatory framework is evolving and a new regulation on batteries and waste batteries has been voted by the European Parliament which is set to come into effect between 2024 and 2028. The regulation introduces the battery passport, which will provide information on the carbon footprint and the recycled content rate. The long-term objective is to ban high-carbon footprint batteries and promote low-carbon ones.

- Our study shows that the carbon footprint of manufacturing a Li-ion battery with NMC chemistry can vary by a factor of 3 depending on the production pathways of the battery materials.

- The current carbon accounting rules advocated by the EU (Product Environmental Footprint methodology and Product Environmental Footprint Category rules) do not take into account the possible production pathways for the main materials of interest in the battery. Therefore, these rules need to be reviewed to improve the level of detail and allow for the differentiation of the carbon footprints of possible battery manufacturing.

- We also conclude that the literature lacks and/or tends to underestimate the precise carbon footprints of the materials of interest in Li-ion batteries (graphite, nickel, lithium). Our study, carried out in close collaboration with industrial players upstream of the Li-ion battery value chain, has provided information on the carbon footprint of these materials for certain production pathways. However, further research is necessary, and we call upon all industries and players in the value chain to participate in future studies and increase the level of knowledge.

I. Introduction

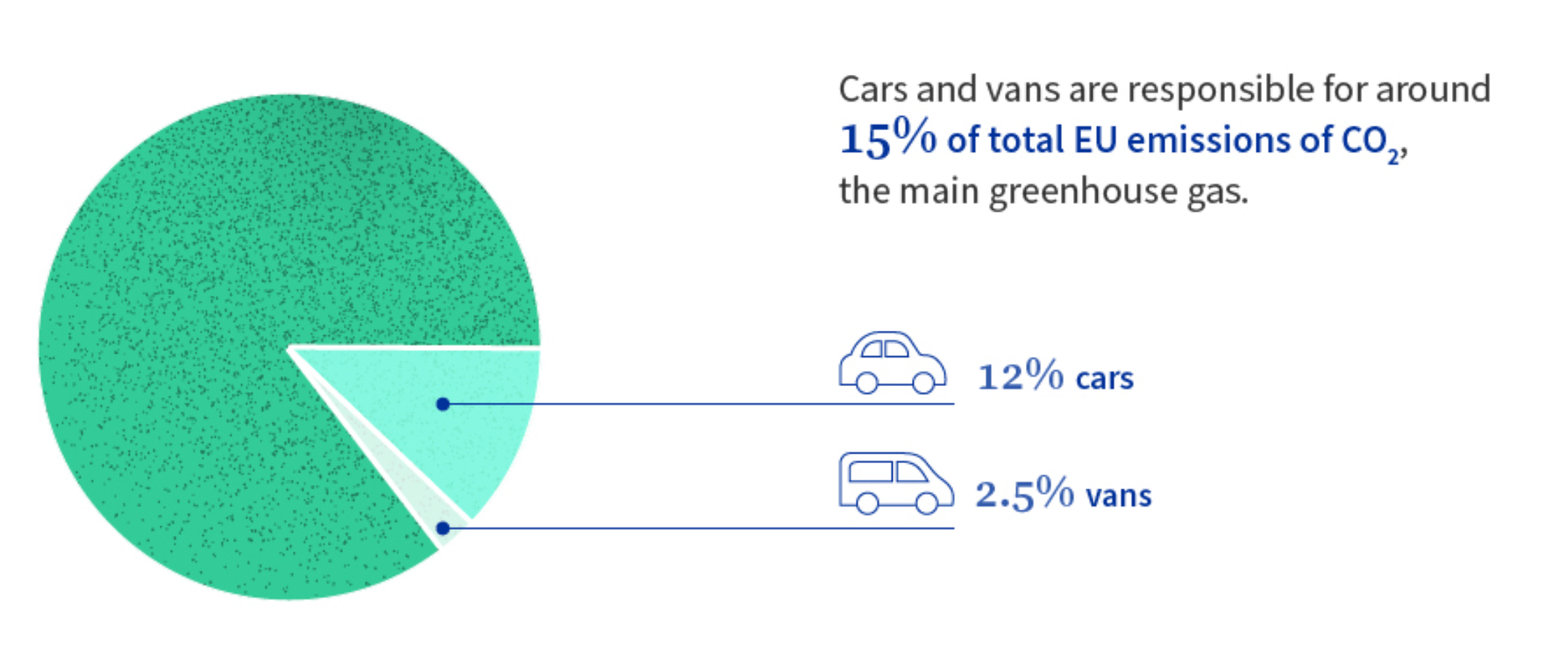

Transportation is one of the most carbon-intensive sectors, and in the EU, road transport is responsible for 15% of greenhouse gas (GHG) emissions[1].

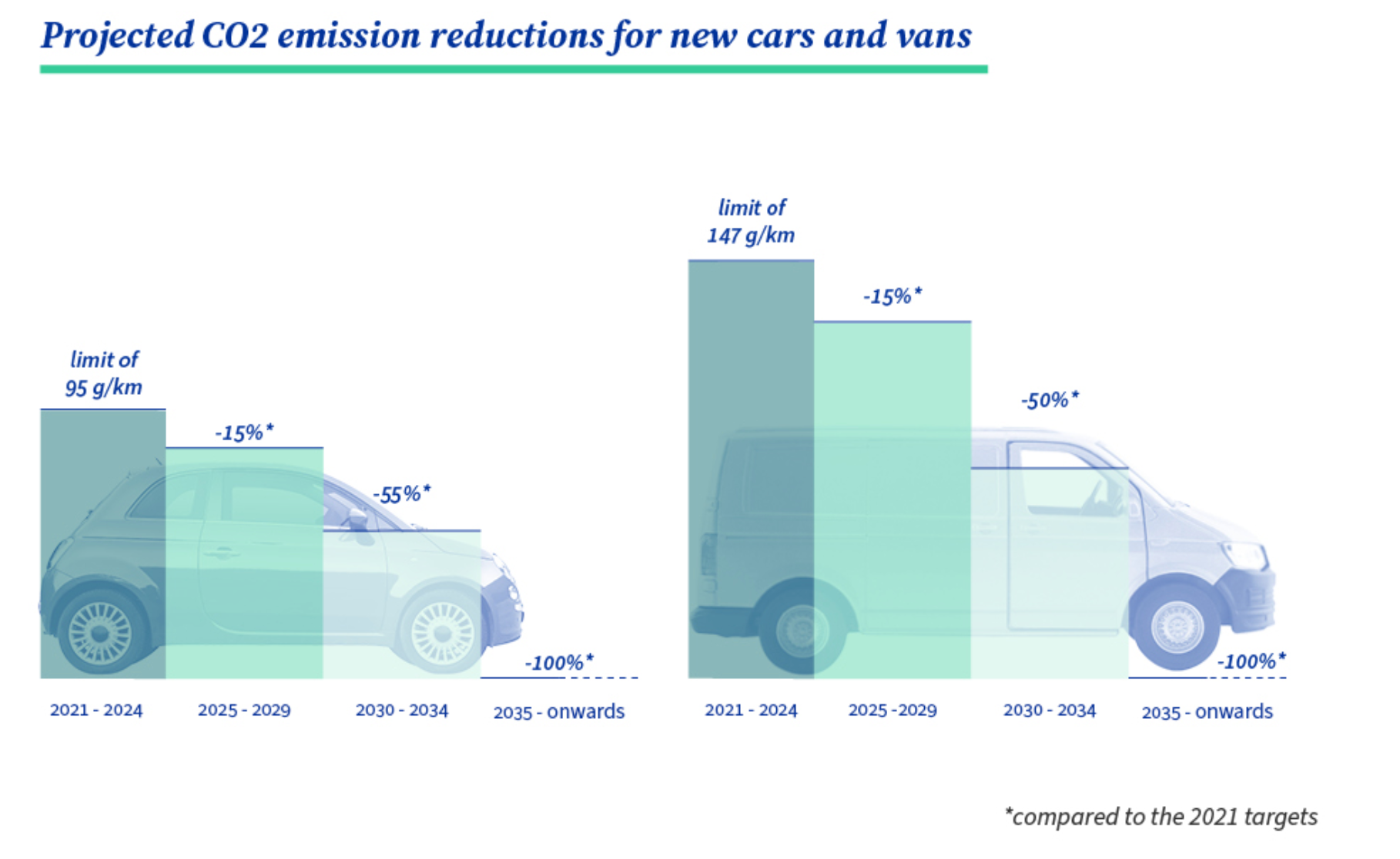

To comply with the Paris Agreement, signatory countries must set reduction targets and implement action plans for this sector.In the EU, the "Fit for 55" package mandates that all new cars introduced to the market should be "zero-emission" vehicles by 2035, with a ban on the sale of new petrol and diesel cars, and that they should comprise 50% of the total fleet by 2050. Hence, car manufacturers are increasingly active in manufacturing and launching new Battery Electric Vehicles (BEVs).

However, the transition to a fleet of electric cars comes with many technical, geopolitical and ethical challenges. For example, there is the issue of the electricity network's ability to handle the increased demand, the reliance on specific materials for battery manufacturing, and the working conditions in the mines where those materials are extracted (For more information on the deployment of electric cars, Carbone 4 has published an article on the subject)

Beyond these issues, the transition requires us to question our mobility habits. For instance, the weight of cars has increased by 30% on average in France in the last 30 years. This trend is increasing the GHG emission linked to the fuel consumption of the mobility. When it comes to Battery Electric Vehicles (BEV), another key ecological criterium is the manufacturing of the vehicle. In this regard, an electric SUV (Sport Utility Vehicle) may not be a “low-carbon” option as the carbon footprint of manufacturing, already the largest emissions category for a BEV, increases even further due to the increased material needs and the larger battery to meet its energy needs.

Electric vehicles are only part of the solution, and developing active modes of transport (walking, cycling) and public transport are also crucial. The cornerstone of the transition is also restraint in transport: reducing the distances traveled and the frequency of travel.

The topic of BEVs is complex and sensitive, and much has been said and written on the subject. Our aim at Carbone 4 is to provide technical insights to support the legitimate questions that can be raised. In this publication, we focus on the carbon footprint of Li-ion batteries throughout their lifecycle[2] with three main objectives:

- Quantify the carbon footprint of Li-ion batteries with high precision, particularly in the upstream part of the value chain.

- Understand the carbon footprint differences between different batteries' value chains. The study revealed that manufacturing a battery NMC (811 52 kWh) in China with carbon-intensive materials could be three times more carbon intensive than in France with less emissive materials.

- Help shape an efficient and ambitious European regulation on batteries to support the development of a sovereign and low-carbon European battery industry

This publication is divided into three parts. First, we review the upcoming regulatory requirements in Europe regarding batteries for mobility. Then, we present our methodological approach and how it meets this new regulatory framework. Finally, we will present two contrasted case studies: one battery manufactured in China versus one manufactured in France.

II. Future regulatory requirements

a. A European sovereignty to be built

The European metallurgical industry, particularly in battery metals, is heavily dependent on imports due to a lack of competitiveness compared to foreign leaders, especially the Chinese industry. This disadvantage is fueled by more lenient environmental regulations overseas. However, the recently introduced European Critical Raw Materials Act[3] aims to reverse this trend and promote greater self-sufficiency.

Creating a European battery sovereignty is more important than ever as it would help control greenhouse gas emissions from battery manufacturing and support the EU's transition to electric mobility. The European Commission’s metallurgical roadmap outlines key priorities to compete with American and Asian players[4]:

- Create innovative sustainable and bankable metallurgical processes to produce raw materials from lower grade and more complex resources (whether primary or secondary)

- Search for alternatives, substitutes applications

- Solve waste valorization specific technical challenges

In the field of Li-ion batteries, many initiatives are already emerging across the value chain. For example:

- Mining: Imerys, a French multinational company specializing in the production and processing of industrial minerals, plans to open one of Europe's largest lithium mines in central France by 2027[5]. Additionally, two lithium extraction projects from geothermal brine in the Upper Rhine Valley region in southern Germany and in France[6][7]. Infinity Lithium also plans to produce lithium hydroxide in San José, Spain, with a fully integrated lithium chemical conversion plant on site[8].

- Manufacturing of cells: In France, two gigafactory projects are being developed by French players to manufacture lithium-ion cells. Verkor's gigafactory is expected to supply 16 GWh of cells per year from 2025, with an ambition to raise this to 50 GWh by 2030. ACC (Automotive Cells & Co) is aiming to launch production in the second half of 2023, with a capacity of at least 13.4 GWh initially, ramping up to 40 GWh by the end of 2029. These two projects combined would enable the production of approximately 600,000 vehicles in 2024 and 1.7 million in 2030[9].

- Pack assembly: In Europe, Forsee Power and Plastic Omnium are working on the assembly of various battery pack components, with a focus on technical optimization and the integration of recycled materials.

- Recycling: the European Commission has invested 70 million euros in a recycling project led by Eramet, ReLieVe. This innovative closed-loop process would make it possible to recover strategic elements - nickel, cobalt, lithium and manganese - with a very high level of efficiency and purity from end-of-life batteries and production waste[10].

b. Future EU regulations

On December 9th, 2022, the Council and the European Parliament reached a preliminary agreement on a proposal for a regulation about batteries and waste batteries. The goal of this regulation is to ensure the sustainability and competitiveness of EU battery value chains[11].

Specifically for electric vehicle batteries, the regulation establishes rules for:

- calculating their carbon footprint: compliance with the latest version of the Commission Product Environmental Footprint (PEF)[12] method and relevant Product Environmental Footprint Category Rules (PEFCRs)[13]

- recycling efficiency (the ratio obtained by dividing the mass of output fractions accounting for recycling by the mass of the waste batteries and accumulators input fraction expressed as a percentage): recycling of 65 % by average weight of lithium-based batteries by 2025 and 70% by 2030

- minimum recovered targets for for cobalt, lead, lithium and nickel for 2030 (with increased targets for 2035): for example 95% for cobalt and 80% for lithium in 2030

- minimum share of recycled content for cobalt, lithium and nickel: for example, 16% for cobalt and 6% for lithium 8 years after the entry into force of the regulation (between 2024 and 2028[14])

Additionally, the regulation addresses technical issues such as end-of-life collection and battery design optimization. For more information please refer to this document.

One of the main objectives of this regulation is to introduce a battery passport for all batteries, which will provide information to the public about the batteries' sustainability requirements. It will also give remanufacturers, second-life operators, and recyclers up-to-date information about the batteries. A QR code on the battery will provide access to information about :

- manufacturing : country, year, capacity, weight,…

- carbon footprint information

- recycled content information

- expected lifetime

- (please refer to annex VI of the previous document for exhaustive information)

The ultimate aim of the battery passport is to ensure that batteries introduced on the European market do not exceed a certain manufacturing emission threshold, emphasizing the importance of accurately calculating battery emissions.

III. Methodological implications of calculating the carbon footprint of batteries

a. What is a Li-ion battery and what materials is it made of?

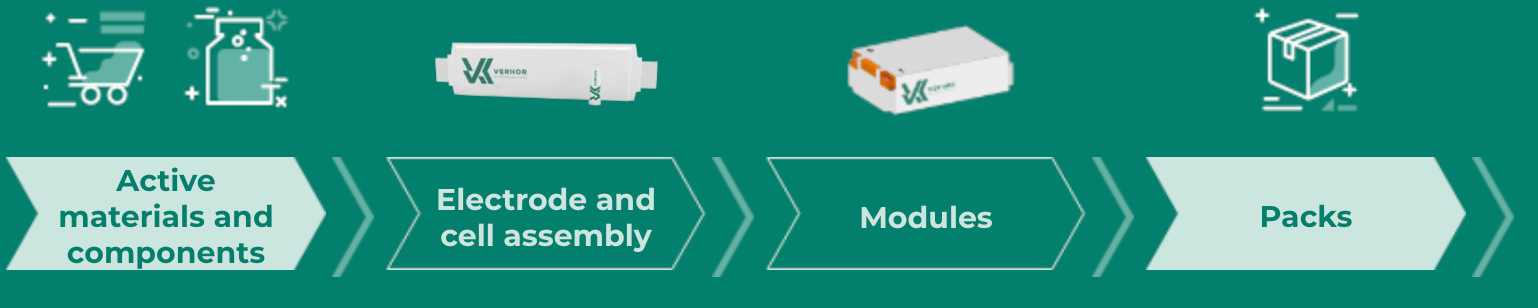

Li-ion batteries are rechargeable batteries that use lithium ions to store energy. Battery packs found in electric vehicles are an assembly of modules that are made up of cells connected to each other, all supervised by a dedicated electrical circuit. The number of cells, the size of each cell and the way they are arranged determine both the voltage delivered by the battery and its capacity, i.e. the amount of electricity it is able to store (in kWh).

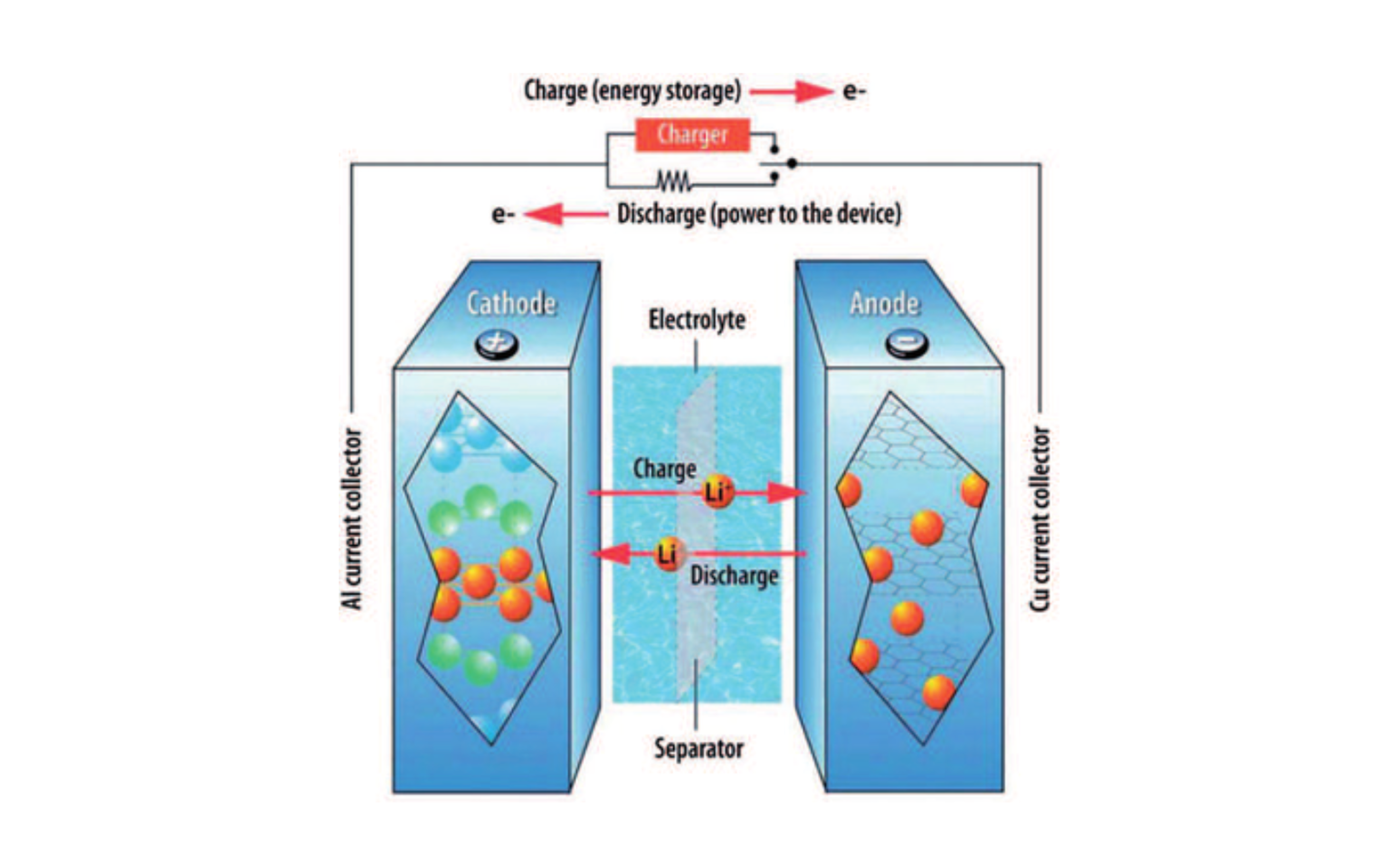

A battery cell consists of 4 parts : a cathode (positive electrode) and an anode (negative electrode) immersed in an electrolyte (an ionic conductive liquid) and separated by a separator (see diagram below). During the operating phase, the potential difference between the anode and the cathode causes ions to circulate inside the electrolyte and creates an electric current. Conversely, during the recharging phase, the energy transmitted by the charger causes electrons to flow back from the positive to the negative electrode, and the lithium ions flow to the negative electrode to balance the electrical charges.

The assembly process for Li-ion batteries involves several steps

- Electrode production: The active materials for each electrode are grinded into a powder. Then, the powder is mixed with conductive auxiliary agents, polymeric binders and organic solvents to form the electrode slurry. It is then coated to metal foils (which act later as current collectors) : copper foil for the anode and to aluminium foil for the cathode. The electrodes are then dried at high temperature.

- Electrolyte preparation: Lithium salts are added to a solvent to form the electrolyte. The solution is placed in the battery to allow ions to flow between cathode and anode.

- Cell assembly: Assembling cathode, anode and electrolyte into a metal casing.

- Battery charge: The battery is charged to force lithium ion to move from the cathode to anode.

- Final assembly: Multiple cells are combined to create a pack.

The assembly process is very energy-intensive. Almost 50% of its energy consumption is due to drying and solvent recovery processes during the electrode manufacturing process. In addition, the entire assembly process takes place in a dry room (humidity less than 5%) which ensures a controlled-contamination environment. This dry room generates an energy consumption that depends on the climate (humidity level) and is around 20% to 30% of the total energy consumption for the assembly.

The GHG emissions from assembly are therefore largely dependent on the energy source used for drying: natural gas or electricity. If the electrodes are dried with electricity, the emissions are driven by the carbon intensity of the grid. Since most batteries are assembled in China (more than 75%), the process is far more emissive than in Europe as the electricity mix uses large quantities of highly carbon-intensive coal.

The assembly however is only one part of the global carbon footprint of the battery. One of the main questions to be answered lies in the metals of interest: the active materials which react chemically to produce electrical energy when the cell discharges. In all current Li-ion chemistries, the active material for the anode is graphite, which can be enriched with silicon. However, for the cathode, the active materials differ based on the specific chemistry, but they always contain lithium. How are these materials extracted and transformed into battery grade metals ? This article will focus on examining the following materials: lithium, nickel, manganese, cobalt, and graphite.

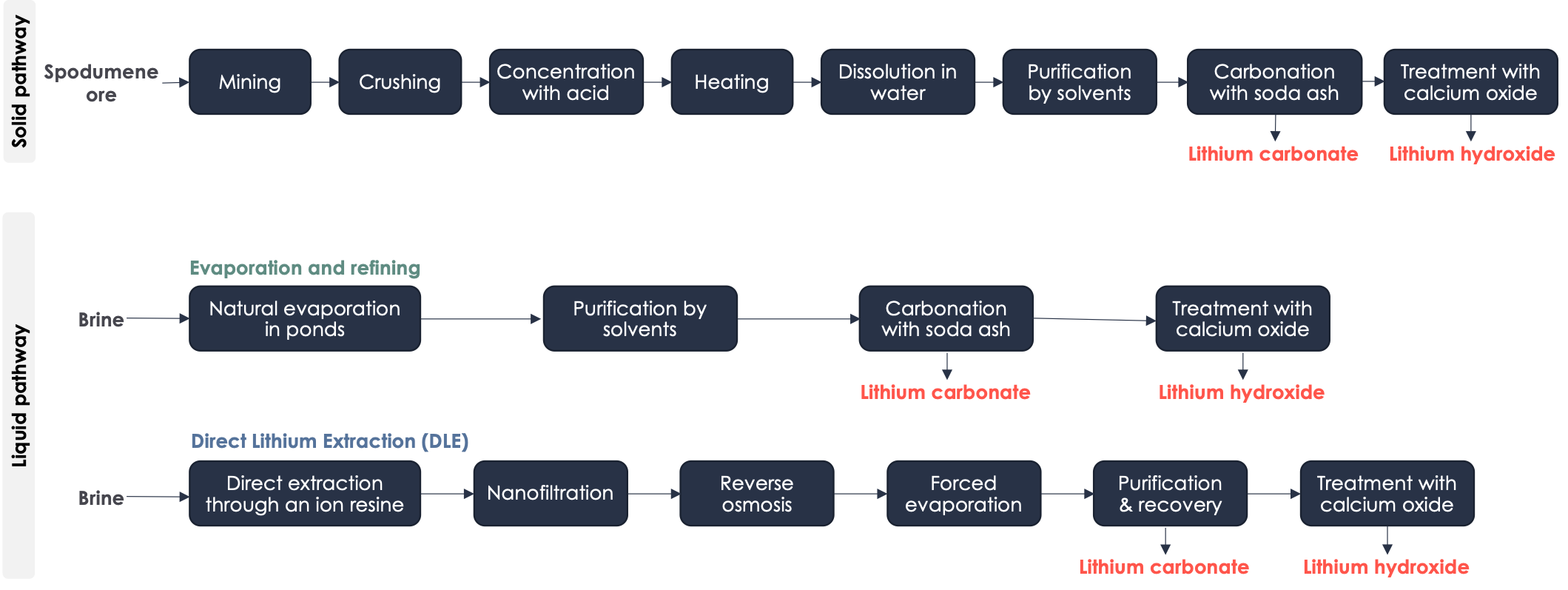

▶️ Lithium : There are two main production pathways for battery-grade lithium.

- Solid pathway - From spodumene ore (LiAlSi2O): Australia is the world's largest producer of lithium through this production pathway[15]. The first step involved in the manufacturing of battery-grade lithium from spodumene ore is underground mining. The crushed rock is mixed with a concentrated acid solution and heated in a rotary kiln to a high temperature of 950°C. This process converts the lithium-containing minerals into a water-soluble form. The resulting mixture is then cooled and treated with water to dissolve the lithium salts. The lithium solution is then purified using a series of chemical reactions that eliminate impurities such as iron and aluminum. The purified solution is treated with soda ash (sodium carbonate) to form lithium carbonate which can be transformed into lithium hydroxide if required (the type of lithium used - carbonate or hydroxide - depends on the battery chemistry). The grinding and heating steps are the most energy-consuming, with the grinding step using 15 to 17 kWh/ton of material processed.

- Liquid pathway - From brine: This brine is typically found in salt lakes, also known as salars, which are located primarily in the Andean plateau of the Chile-Argentina-Bolivia triangle. It can also be found in the Qaidam basin in China and the Clayton Valley in the USA. Within these lakes, lithium is present in a dissolved state and is typically in the form of LiCl.

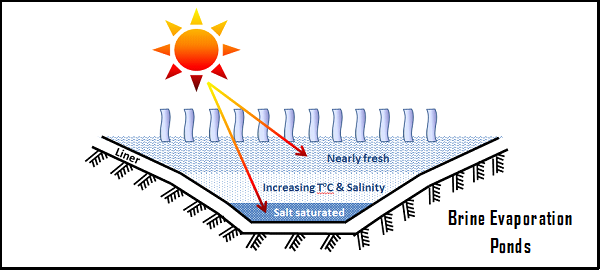

- Process of evaporation and refining : This is the most common process used for the production of lithium from brine. First, the brine is placed in large evaporation ponds, which can be up to 1km in length. The high evaporation rates in the arid regions where the salt lakes (salars) are located allow the dissolved salts to concentrate. The second step is the purification of the solution by solvent extraction, which removes traces of impurities such as limestone, manganese, sulphate, arsenic and sometimes bromine. The resulting lithium obtained is pure and can be carbonated to form lithium carbonate, which can then be transformed into lithium hydroxide if necessary. The co-products of this process include potassium, bromine, boron and sodium, which historically have ensured the economic profitability of these operations, although the evaporation times can be relatively inflexible. One of the major disadvantages of this production method is the high water consumption through evaporation in the arid areas where the salt lakes are located.

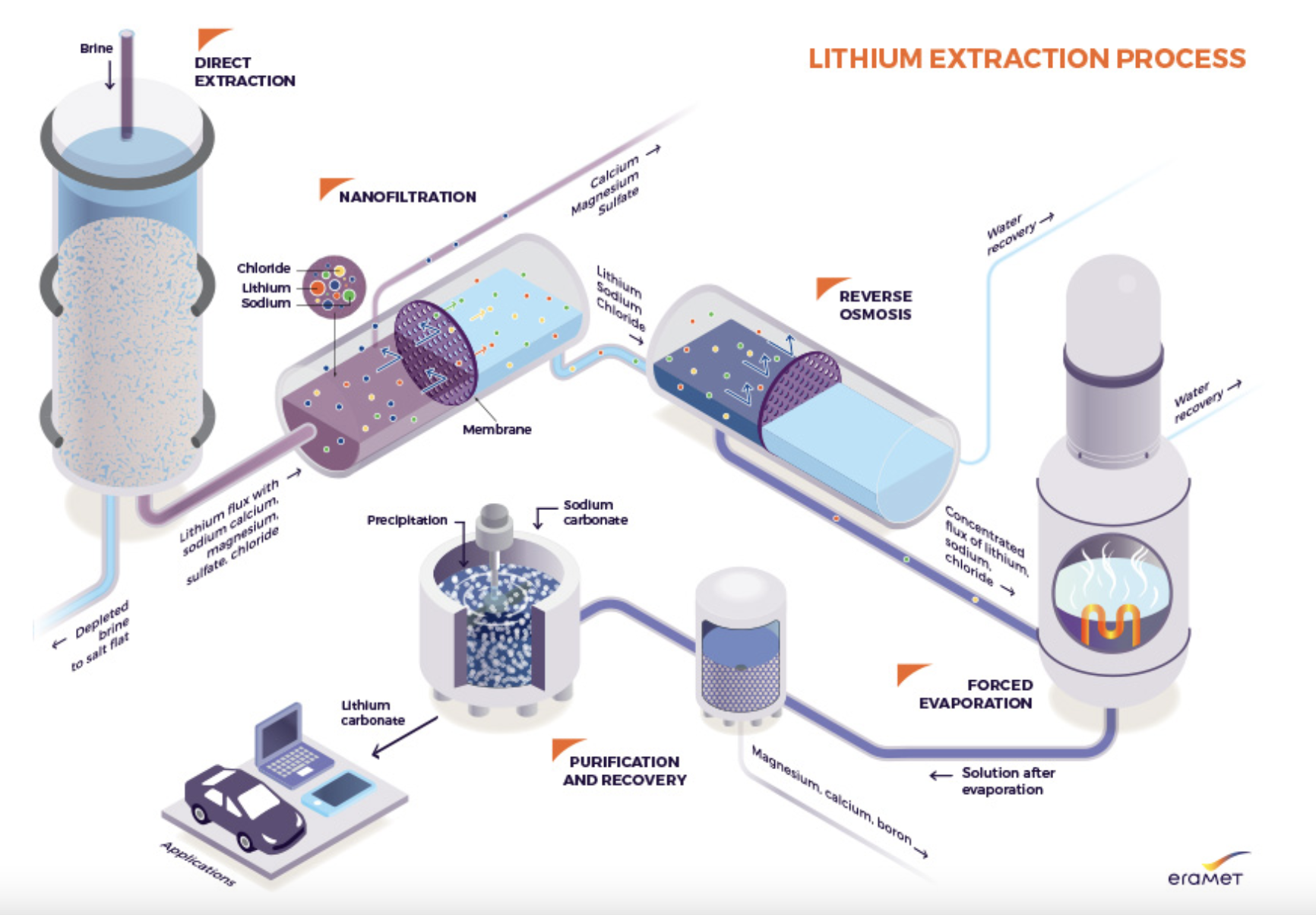

- The Direct Lithium Extraction (DLE) process eliminates the need for the evaporation step. Instead, brine is concentrated by adsorption using an ion exchange resin, followed by nanofiltration to remove ions other than lithium. Lithium, being the smallest solid atom, is then concentrated through reverse osmosis and evaporation (i.e., by heating the solution). Finally, the hydrometallurgical purification steps are the same as those used in the evaporation and refining process.

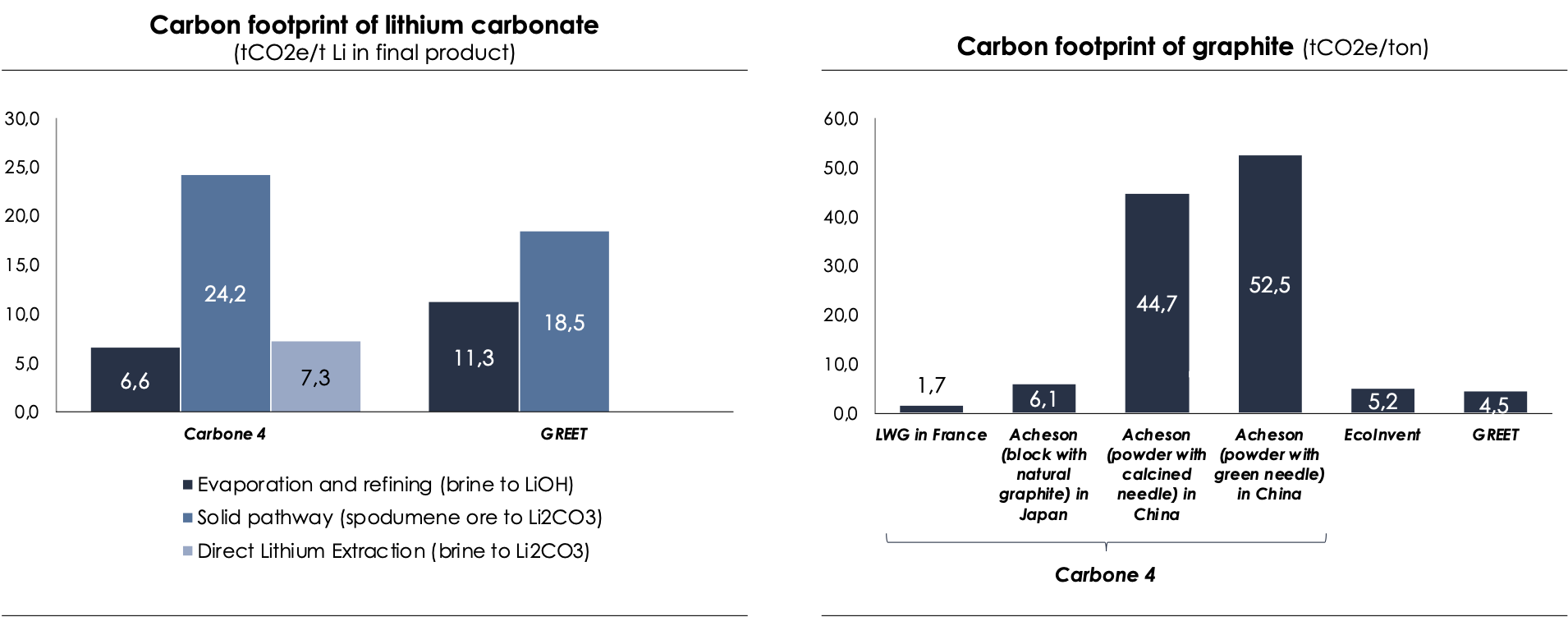

The process of producing battery-grade lithium from brine is five times less emission-intensive than from spodumene. However, brine reserves are more limited. To meet the demand for battery-grade lithium, experts estimate that all existing sources of lithium will have to be exploited. Although other production methods exist such as using lepidolite, mica, jadarite, hectorite ores, lithium clay, and geothermal brines, the quantities produced from these sources remain small.

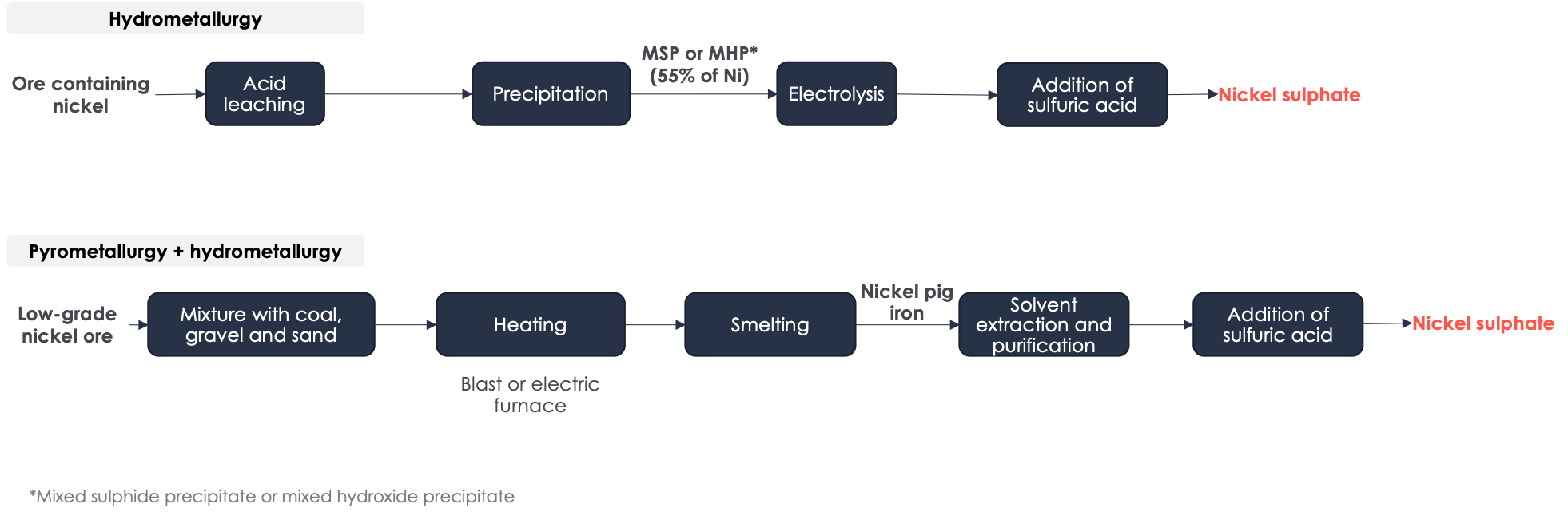

▶️ Battery-grade nickel is produced from nickel sulphate. Nickel sulphate can be produced by hydrometallurgy alone, by a High Pressure Acid Leaching and Base Metal Refinery (HPAL + BMR) process or by pyrometallurgy followed by hydrometallurgy (”pig iron” pathway).

- The process of hydrometallurgical production of NiSO4 (HPAL + BMR) involves several steps that use acid solvents and electrolysis to concentrate and purify the ore. This method has the potential to produce valuable co-products such as copper, cobalt, or iron. However, this process is not yet fully mature as it has only been around for about 30 years and opening a hydrometallurgical plant can still be a complex undertaking.

- The primary method for nickel production today is through the production of nickel pig iron. Originally, it was used as a cheaper alternative to pure nickel for the production of stainless steel. Nickel pig iron is made from low-grade nickel ore, coking coal, and a mixture of gravel and sand as an aggregate. The mixture is then heated in blast or electric furnaces, and impurities are removed through smelting. This process results in high greenhouse gas emissions. To produce NiSO4, the obtained ingots are further processed using solvent-intensive hydrometallurgical processes. Most nickel pig iron is produced in Indonesia and refined either on site or in China. Only countries with low costs and lax environmental policies can afford this highly energy and solvent-intensive process. In Europe, this method is simply not viable due to energy prices.

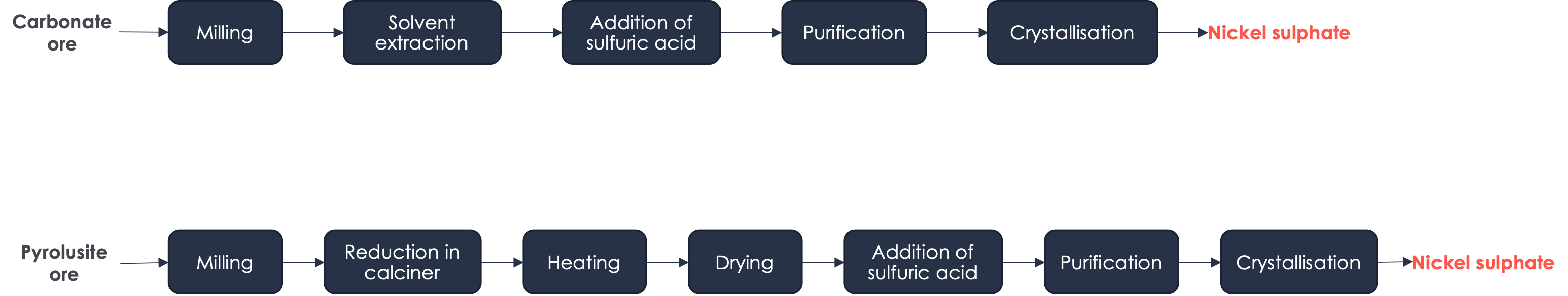

▶️ Manganese : the battery-grade manganese is in the form of MnSO4.

- Manganese sulfate (MnSO4) can be produced from either carbonate ore or pyrolusite ore. In the case of carbonate ore, the process involves milling, solvent extraction, and drying of the ore, followed by the addition of sulfuric acid, purification, and crystallization. In the case of pyrolusite ore, the process involves milling, reduction in a calciner, heating, drying, addition of sulfuric acid, purification, and crystallization.

▶️ Cobalt : The Copperbelt region in the Democratic Republic of the Congo and Zambia is responsible for producing most of the world's cobalt. Cobalt is obtained as a byproduct of the extraction of copper, nickel, and even lead ores. We did not delve into the production processes of cobalt in detail due to a lack of information on its carbon footprint. Therefore, we had to rely on existing literature such as GREET and EcoInvent to obtain the necessary information.

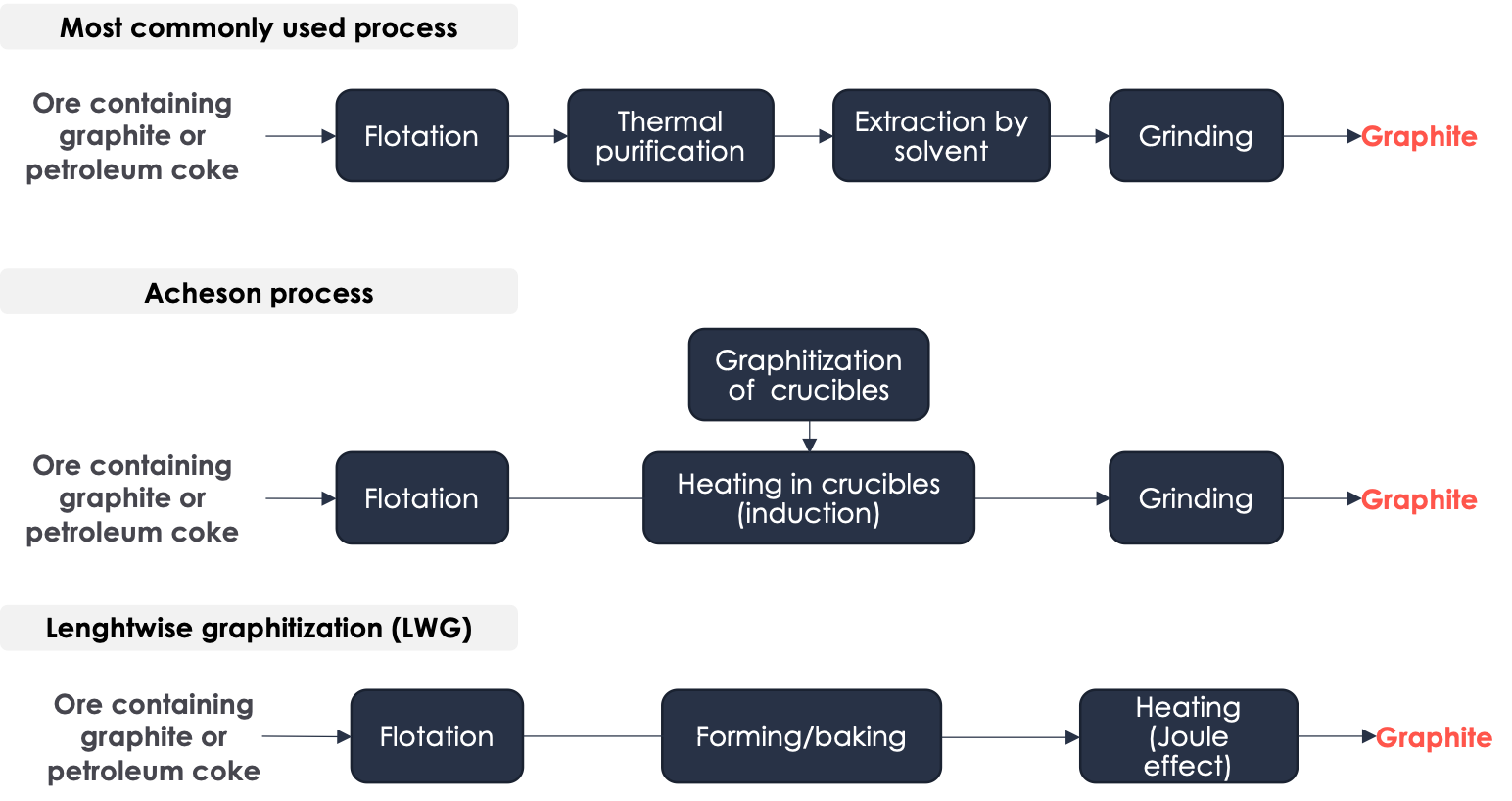

▶️ Graphite refers to a specific arrangement of carbon atoms in a crystalline form. This arrangement consists of a stack of planes, each made up of hexagons in a honeycomb pattern. There are two primary kinds of graphite - natural graphite, which is made from ores containing 5 to 30% carbon, and synthetic graphite, which is produced from petroleum coke. Synthetic graphite offers superior performance in terms of energy density and lifespan. China is the primary country for refining graphite and produces between 60% and 80% of the world's graphite.

- The most commonly used method of production involves several steps. Firstly, a process called flotation is used to separate minerals based on their hyprophilic/hydrophobic properties. Then, the ore is thermally purified at a temperature of 1000°C to obtain a material containing 98% carbon. Next, a chemical extraction process is used to further refine the material. Finally, the material is ground using a jet mill, which utilizes a high-speed jet of compressed air or inert gas to cause particles to impact each other.

- Another commonly used production method is the Acheson process. This process involves the same initial step of flotation, followed by heating the ore in graphite crucibles to a temperature of 3000°C, and then grinding the resulting material using a jet mill. However, the Acheson process is known for having low energy efficiency and also generates greenhouse gas emissions due to the consumption of the graphite crucibles during the process. Both of these production methods are used in China.

- There is another production process that is less carbon-intensive than the previous ones mentioned - the lengthwise graphitization (LWG) process. This method involves several steps, including flotation, forming, and baking. During the LWG process itself, the material to be graphitized is heated using the Joule effect instead of through conduction as in the Acheson process. This results in lower energy losses and produces graphite with a higher energy density.

b. The importance of granularity for carbon footprint calculation

Through calculating the carbon footprint at the manufacturing process level, we have been able to achieve a higher level of detail and identify significant differences from the average values found in existing literature. For example, GREET (Greenhouse gases, Regulated Emissions, and Energy use in Technologies)[16] results, which are sponsored by the U.S. Department of Energy's Office of Energy Efficiency and Renewable Energy and assess the energy and emission impacts of battery electric vehicles (BEVs) from the initial production to disposal, are considered authoritative but still lack certain crucial information. Our primary findings are discussed below and highlight the fact that the current level of detail provided in literature is insufficient and needs to be increased and standardized in order to better assess the actual differences in carbon footprint between different types of batteries.

- Graphite

- The GREET model and EcoInvent report greatly underestimate the carbon footprint of graphite produced using the Acheson process. Our study found that the emissions associated with the graphite crucibles used in the process were not considered, despite the fact that these crucibles are made of synthetic graphite and weigh twice as much as the graphite produced. Additionally, these crucibles have a limited lifespan and can only be used for up to 4 graphitization cycles.

- Lithium

- It is not possible to exclude the indirect emissions associated with the use of reagents (scope 3) as doing so would skew the results. For instance, a lithium producer in Chile claims to have a carbon footprint of only 2.9 kgCO2e/kg LCE (lithium carbonate equivalent), which would make it the least carbon-intensive production method by a significant margin. However, this value only takes into account the direct emissions (scope 1 and 2). When the indirect emissions are also factored in, the carbon footprint rises to 6.6 kgCO2e/kg LCE.

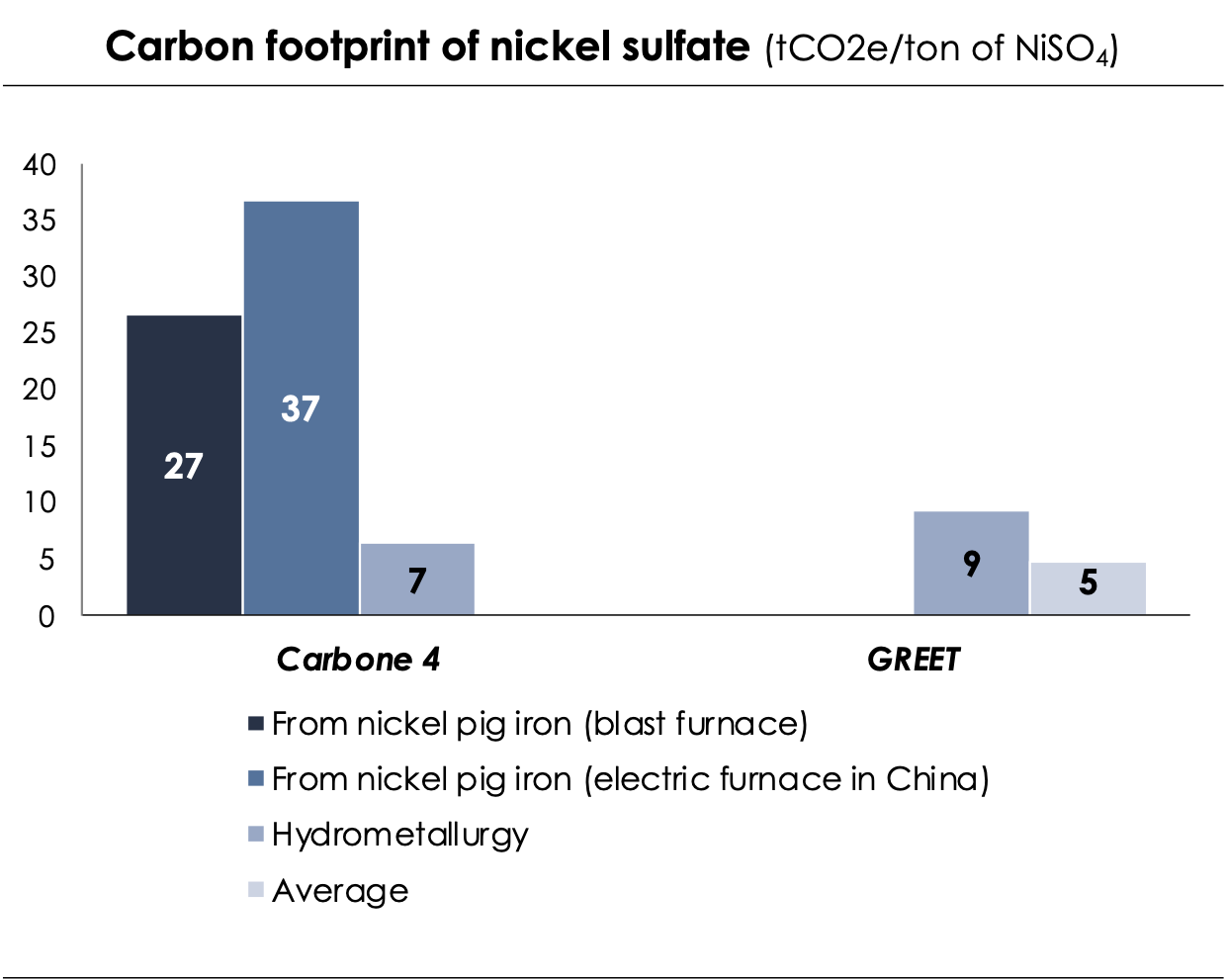

- Nickel

- In recent years, a production method for nickel sulphate from nickel pig iron has become increasingly popular in China. This method, which was not considered in the GREET model, has a carbon footprint that is approximately 4 times higher than that of nickel sulphate produced using the high pressure acid leaching process.

Our method of calculation enables us to identify the primary differences in carbon footprint between production processes, but there are some distinctions that are challenging to capture, such as the specific energy source used, the quantity of solvent required based on the mineral's purity level, the source of the solvents, and so on.

IV. Illustration: two batteries with different carbon footprints

a. Presentation of the study

Over a period of 10 months, we collaborated with 10 stakeholders from the battery industry in Europe, including ERAMET, Verkor, Infinity Lithium, Tokai Cobex, EDF, Forsee Power, MTB, and Plastic Omnium. The primary objectives of our study were to:

Precisely quantify the carbon footprint of Li-ion batteries, particularly in the upstream part of the value chain.

Analyze the differences in carbon footprint among various production processes of batteries.

Facilitate the development of a sustainable and low-carbon European battery industry by contributing to the creation of efficient and ambitious regulations on batteries.

Through extensive discussions with the partners and their process experts, we gained valuable insights into the battery production routes and also accessed primary industry data. Additionally, we reached out to the PEF for reference. We developed a tool to calculate the carbon footprint of Li-ion batteries across their entire life cycle, allowing for further refinement by production process, country of assembly, and country of use.

By modeling two contrasting case studies, we aimed to understand the potential difference in GHG emissions between low-emission batteries and carbon-intensive ones.

b. Rationale for the two study cases

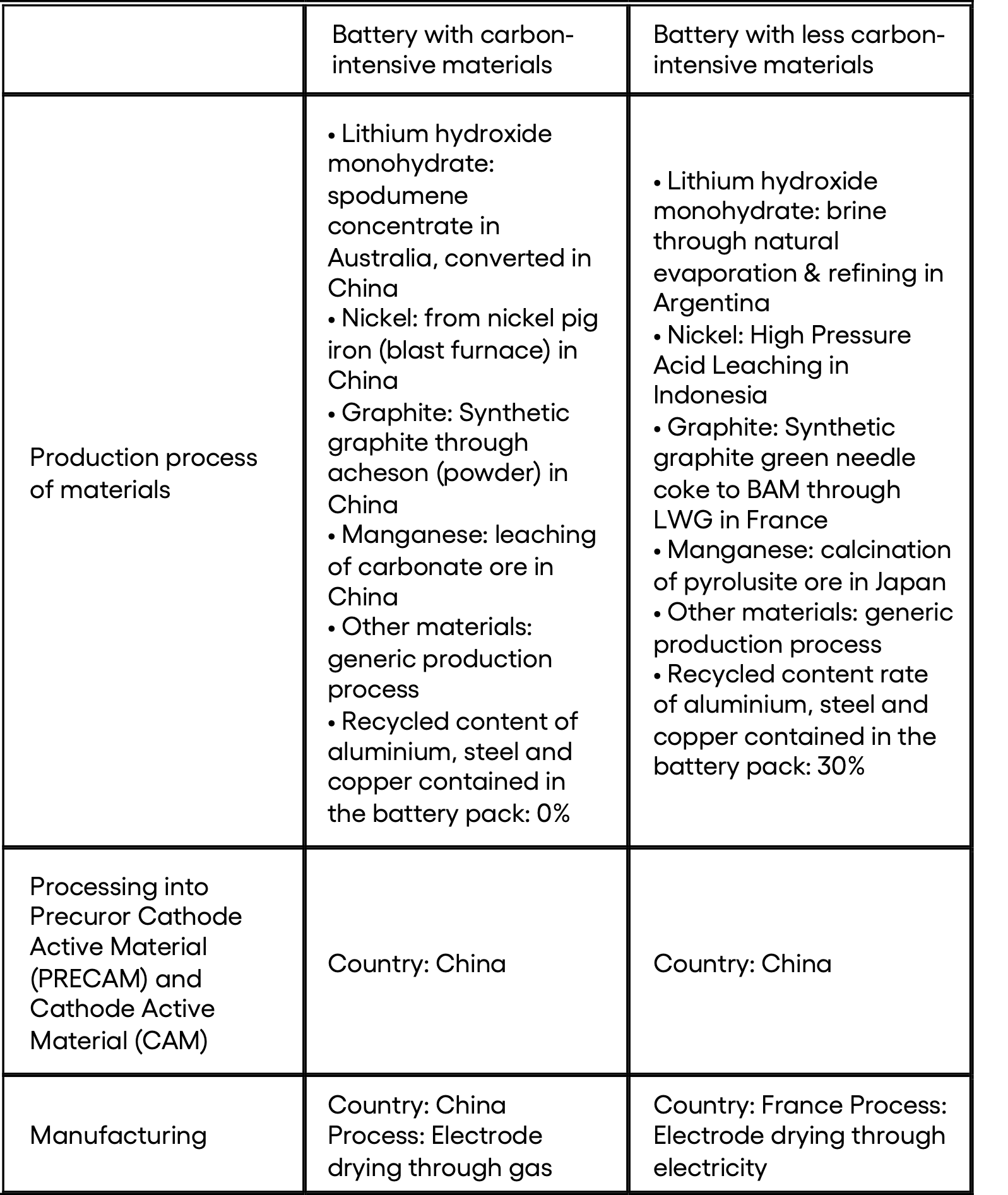

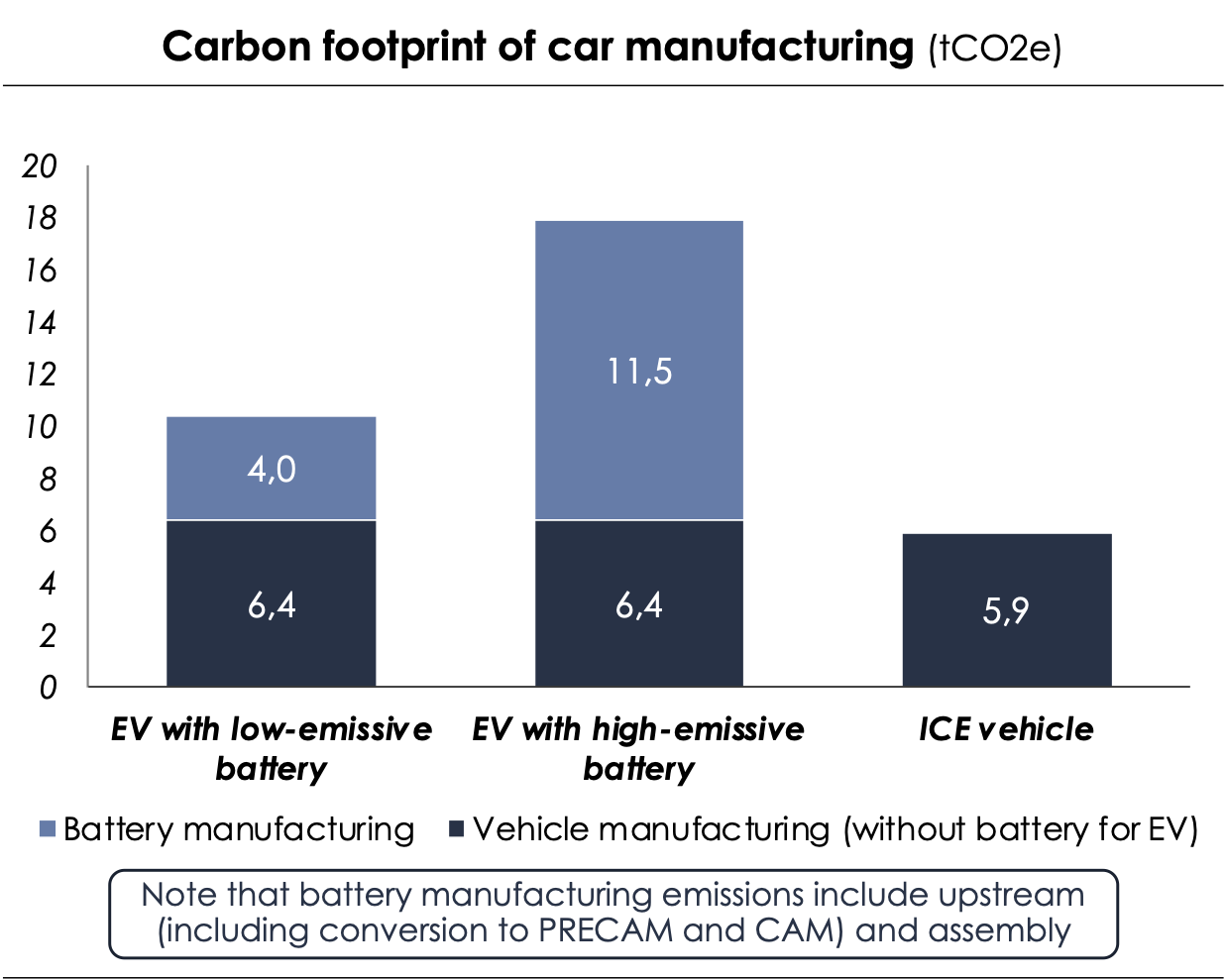

The assumptions made for each case are :

- Chemistry : NMC 811 - corresponds to a new industrial standard for high-performance batteries that contain significantly less cobalt. This is an important development as cobalt mining has been associated with ethical concerns.

- Capacity : equivalent to the battery of a small urban vehicle (52 kWh)

- See the details of production pathways in III.a.

c. Carbon footprint results

The study shows that the largest part of the carbon footprint of Li-ion batteries (about 80%) is due to the upstream materials, rather than the assembly or usage.

The gap in carbon footprint over the lifetime between the battery with carbon-intensive materials and the one with less carbon-intensive materials is 60%. This is mainly due to the upstream materials (+70%) and the assembly (+70%) (see chart below). Within upstream materials, the largest differences in carbon intensity are observed for graphite (x30) and nickel (x3), which is consistent with the improvements to the model explained in Part III.

In conclusion, after refining the calculations for some materials, the carbon footprint falls between 77 and 221 kgCO2e/kWh, compared to the range of 53 to 68 kgCO2e/kWh calculated by the GREET laboratory for the same chemistry[17]. This highlights the need to continue improving the current calculations and establish an ambitious maximum threshold for the carbon footprint of batteries that are sold in the European market.

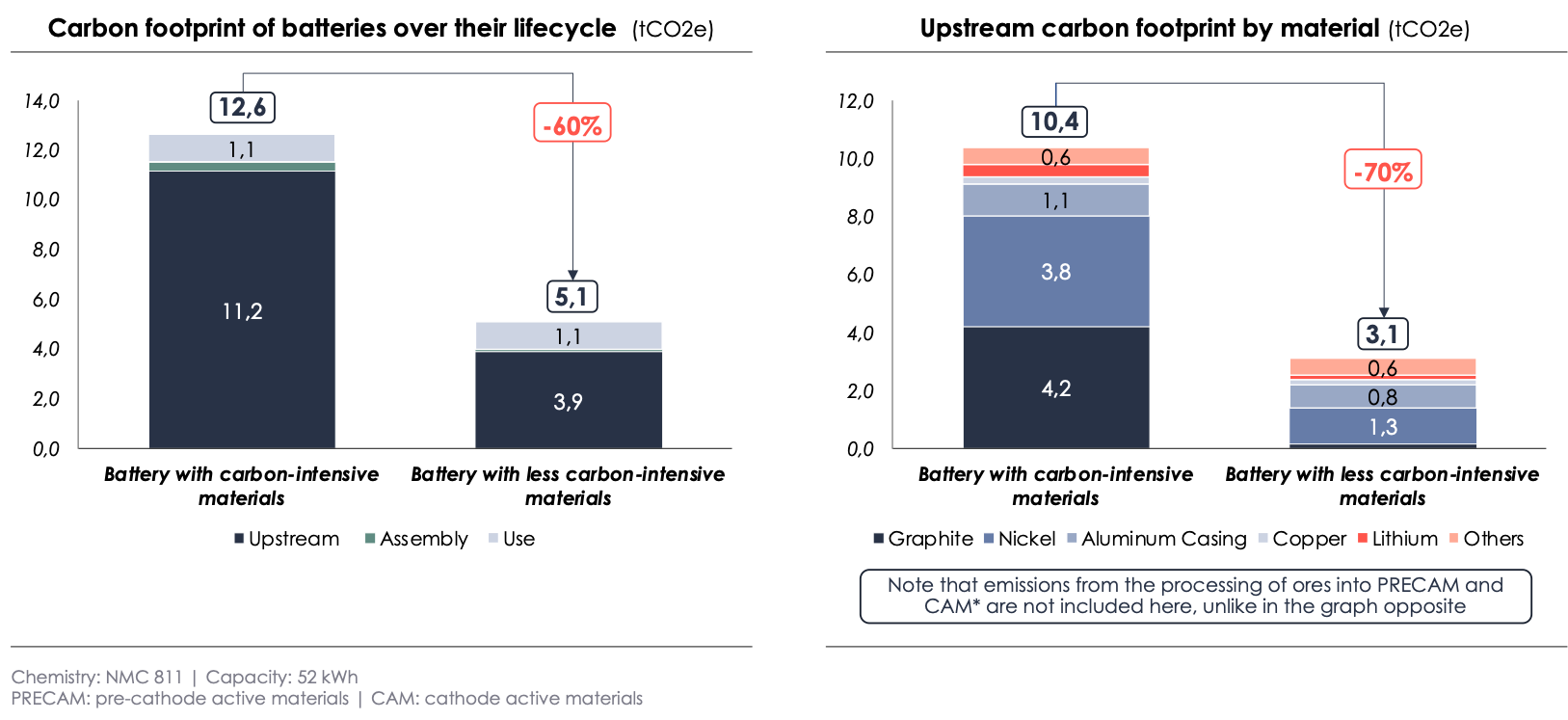

With the the carbon footprint values obtained, we demonstrate that the environmental benefits of an electric vehicle (EV) over an internal combustion engine (ICE) can be achieved three times faster if the battery contains materials with lower carbon intensity than those with higher carbon intensity.

Indeed, according to the “Fondation pour la Nature et l'Homme”[18], the carbon footprint of manufacturing a combustion engine city car ICV is 5.9 tCO2e, whereas that of a similar electric vehicle (excluding the battery) is 6.4 tCO2e - the difference being explained in particular by the higher quantity of ferrous materials for the electric car. So, according to our calculations of a battery’s carbon footprint, the manufacturing an electric vehicle (assembly + battery included) then emits between 10.4 and 17.9 tCO2e, i.e. more than a combustion engine car. The ecological advantage of an electric vehicle lies in its use, which is less carbon-intensive compared to burning fossil fuel. There is a specific point, known as the "kilometer tipping point," beyond which the excess carbon footprint of manufacturing the EV battery is offset by its use. This means that beyond this point, the EV becomes less carbon-intensive than a combustion engine car. Based on the average yearly distance travelled by car, which is 12,000 km[19], the car with the battery made of less carbon-intensive materials manufactured in France reaches the kilometer tipping point in approximately two and a half years after its introduction, while with the battery made of carbon-intensive materials manufactured in China, it takes six years of use before reaching the kilometer tipping point.

V. Conclusions

The carbon footprint of a Li-ion battery with the same chemistry and capacity can vary by up to three times depending on the production process used. Therefore, it's essential to consider the details of the materials and assembly process when manufacturing these batteries.Electric vehicles equipped with batteries manufactured in France using low-carbon materials have a lower carbon footprint (including both manufacturing and use) than ICE vehicles, approximately two and a half years after their start of use. However, with batteries made from carbon-intensive materials manufactured in China, it takes six years of use for the vehicle to reach the "kilometer tipping point.”

We believe that EU carbon footprinting standards should consider the origin and manufacturing process of the materials used. Additionally, the EU should set ambitious carbon performance thresholds for batteries in order to help build a European low-carbon battery industry, and avoid importing batteries from China or produced on European soil by Asian industries with a high carbon value chain.

Although there have been significant improvements in calculating the carbon footprint of Li-ion batteries, such as specifying the carbon footprint by production process for lithium, graphite, and nickel and assembly emissions by country of production, there still are areas of improvement.

Season 2 of this work on batteries could focus on:

1/ refining the model:

- emissions from production of manganese and cobalt

- the manufacture of PRECAM and CAM

- assembly yields

- recycling

2/ being prescriptive on the carbon performance thresholds of batteries and the data to be reported by battery producers.