Climate Stress Tests: how to read the results of the exercise?

The ACPR (the French Prudential Supervision and Resolution Authority) together with the Banque de France (French Central Bank) conducted a climate stress testing pilot exercise from July 2020 to April 2021 [1] to assess the exposure of banks and insurers climate risks. It mobilised 9 banking and 15 insurer groups, covering respectively 85% and 75% of their total balance sheet.

This exercise is part of movement from European supervisors and regulators to assess the risks and challenges posed by climate change on financial stability: the Bank of England and the European Central Bank will conduct climate stress testing exercises on the basis of the same scenarios (provided by NGFS, the Network for Greening the Financial System); while the Basel Committee is advancing on its strategy to integrate climate related financial risks into banking prudential regulation (see the analysis from Carbone 4).

Despite current limitations due to the pioneering nature of this exercise, we welcome its realisation which has the merit of raising awareness on climate-related financial risk.

As climate stress testing will become recurrent, banks and insurers will have to gain expertise in climate scenario modeling, understanding of climate risk transmission channels and rely on better forward-looking data and improved methodologies.

This exercise involves stressing the balance sheets of French banks and insurers with a set of common hypotheses: a long time horizon (2050), the use of transition and physical risk scenarios broken down in sectors, and a dynamic balance sheet assumption (institutions can adapt their balance sheet over time).

Participants were subject to three transition risk scenarios (all reaching “net zero” emission), and one physical risk scenario, (the RCP8.5 from the IPCC, or a “Business as Usual” scenario), based on a 30-years time frame. The exposure of French banks and insurers to transition risks is revealed as “moderate”, but our analysis shows that several elements indicate a potential downward bias, or an underestimation of transition risks. Physical risks lead to a significant increase in sinistrality and insurance premiums. While these do not directly endanger insurers balance sheets, it will widen the insurance protection gap, with the insurability line being pushed further.

A « moderate » exposure to transition risks showing potential for methodological improvement

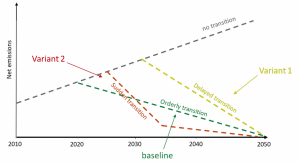

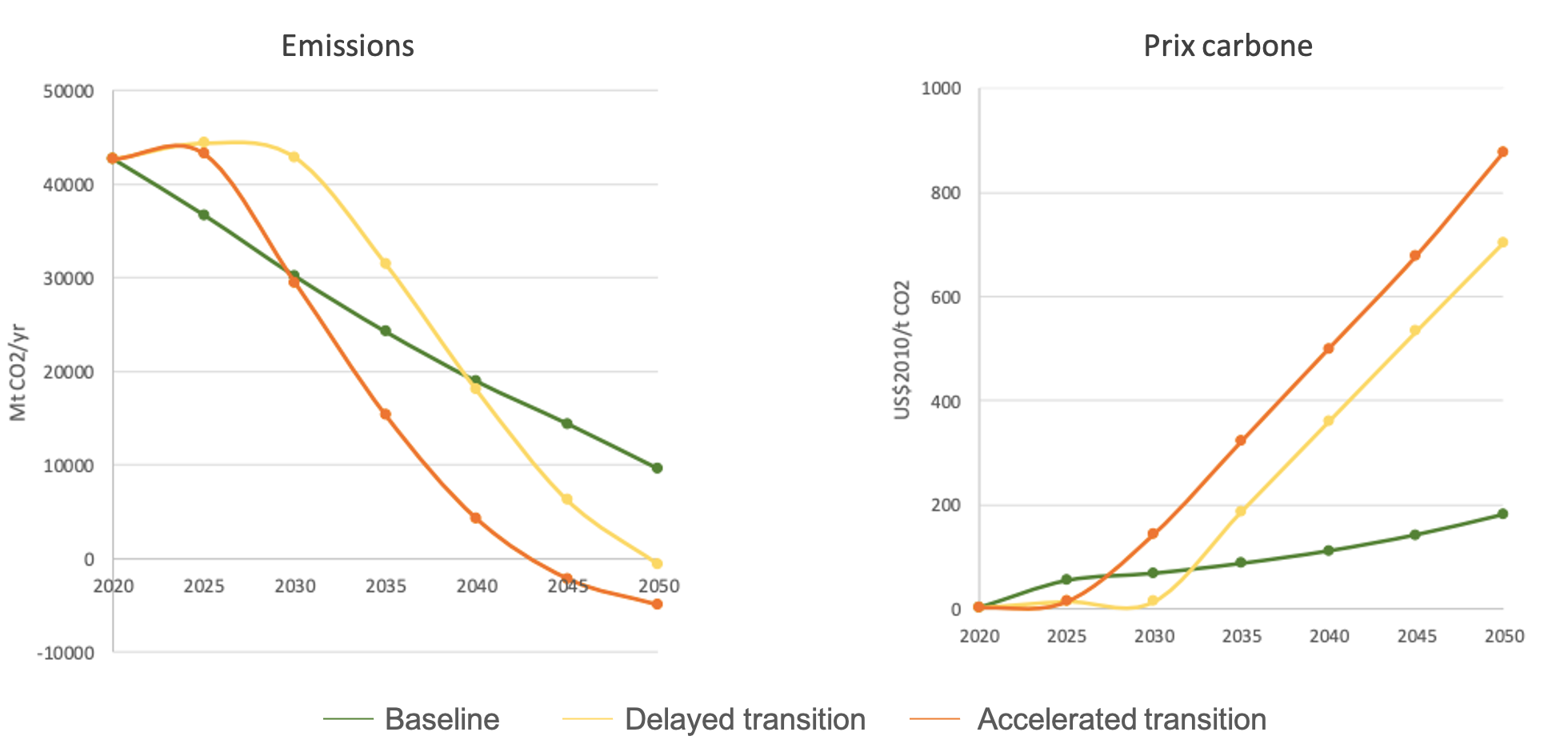

Regarding transition risk, three transition scenarios were used. All three imply a steady decline of emissions to reach “net zero” in 2050, including one in line with the SNBC (French Low Carbon National Strategy), one with a “sudden” transition and one with a “delayed” transition (see Chart 1).

Chart 1 – Schematic representation of the transition and physical risk scenarios included in the ACPR pilot exercise

The exposure of French banks and insurers to transition risk is deemed as “moderate”, with an increase of French banks’ cost of risk [2] between 30% and 40% (the covid-19 crisis increased it by 100%). However, several elements suggest a downward bias in this result, underestimating the level of exposure to transition risks.

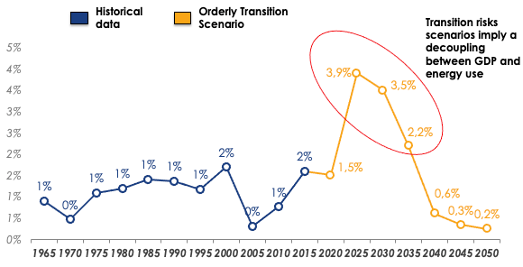

A decoupling assumption between GDP growth and emissions leading to an absence of an output shock

Scenarios rely on a decoupling between emissions and GDP growth, since they all envision GDP growth while reaching emissions “neutrality”. This has nos been a reality in the past and the fact that it will become so in the future is questionable (see Chart 2).

Chart 2 – Growth rate of the GDP (US$ 2010)/World Primary Energy Consumption (EJ)

Historical data: World Bank; BP Statistical Review of World Energy

From 2020: NGFS scenarios used for the stress tests (REMIND-MAgPIE 1.7-3.0)

This implies that a rapid reduction of emissions could be achieved without a significant impact on GDP (by way of comparison, regular biannual stress tests conducted by the EBA require scenarios based on three consecutive years of GDP contraction). Consequently, banks’ credit exposures are subject to variations in prices from the trajectory of a carbon tax, and productivity of factors, but not to a decline in economic output.

Having three scenarios that include (some) GDP growth, and a net zero trajectory diminishes the variability between the scenarios, and thus between the output of the stress tests, a pitfall identified by the ACPR.

Chart 3 - Carbon emissions and pricing trajectories of ACPR scenarios (source ACPR, p.20)

The limits of the sectoral classification

The sectoral structure of French banks’ balance sheets contributes to the assessment of a “moderate” exposure to transition risks. The seven most impacted sectors, described as “sensitive sectors”, see their cost of risk raise threefold by 2050. These sectors represent 9,7% of banks' corporate credit exposures, limiting the global exposure. The ACPR underlines the large scale of impacts in these sectors: “However, the substantial increase in the cost of risk in some sensitive sectors, which is already induced by the orderly transition scenario, indicates that the energy transition which is necessary in order to comply with the Paris Agreement, presupposes a considerable effort to adjust the system and the economic structures”.

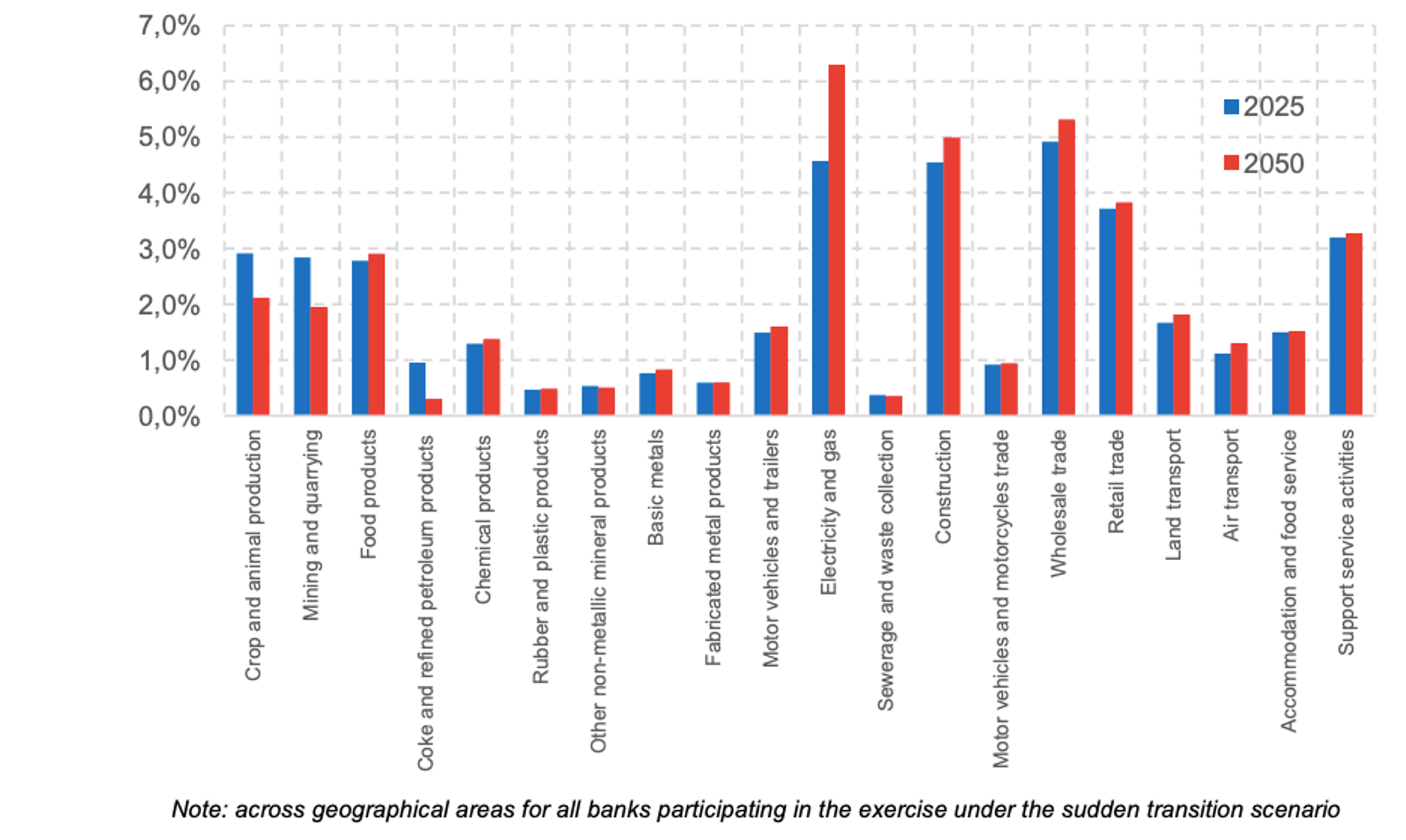

Chart 4 - Sectoral structure of credit exposures (source ACPR, p.16)

We note that the “Electricity and gas” sector, “which stands to benefit from the transition in the scenarios, sees its share in total exposure increase sharply”. Thus, gas, a fossil fuel, see the share of credit exposure in the sector in which it is included, increase to reach the highest exposure of French banks balance sheets by 2050. As a reminder, electricity generation from a gas power plant emits 418gCO2e/kWh [3] and would be sensitive to a carbon tax increase (after potentially benefiting from the rule-out of more carbon intensive sources of electricity production such as coal). The scenarios used in these stress tests see the carbon pricing reach 704$/t (delayed transition) or 917$/t (sudden transition) in 2050 (see Chart 3). The report recognises a potential for methodological improvement. « A […] difficulty lies in the identification of sectors that are sensitive or exposed to climate risk: this identification first of all depends on the method used. It then implies assumptions on the evolution of the energy mix, the intensity and the energy efficiency of production, which were not properly integrated in this exercise ».

The lack of a feedback mechanism between sectorial reallocation and prices could create a downward bias in transition risk exposure assessment

In this exercise, banks (and insurers) were free to adapt their balance sheet under the three transition scenarios, enabling participants to redistribute their corporate credit portfolio in different economic sectors. For instance, under the sudden transition scenario, banks’ exposure to electricity and gas, construction and wholesale trade industries increases in most cases, while financial institutions lower their exposure to coke & refined petroleum products, mining & quarrying, and agriculture & animal breeding sectors. French insurers did not alter significantly their portfolio structure.

The ability of banks to dynamically adjust their balance sheet reduces the cost of risk, especially in sensitive sectors. However, a limit to this exercise is the absence of consideration of second round effect from sectorial reallocation (further decline in asset prices as exposures are removed from balance sheets). The report also notes that the “absence of feedback effects between the sectoral structure of the balance-sheet of the financial sector and financial risks (generated by climate change) does not necessarily encourage institutions to implement an active risk reduction policy, as most of the transition scenarios considered reach the objective of carbon neutrality in 2050”. This implies that further sectoral reallocation could be considered, triggering a downward spiraling effect in terms of asset prices, macroeconomic data such as GDP and the level of interest rates.

Physical risks: an increase in sinistrality and insurance premiums

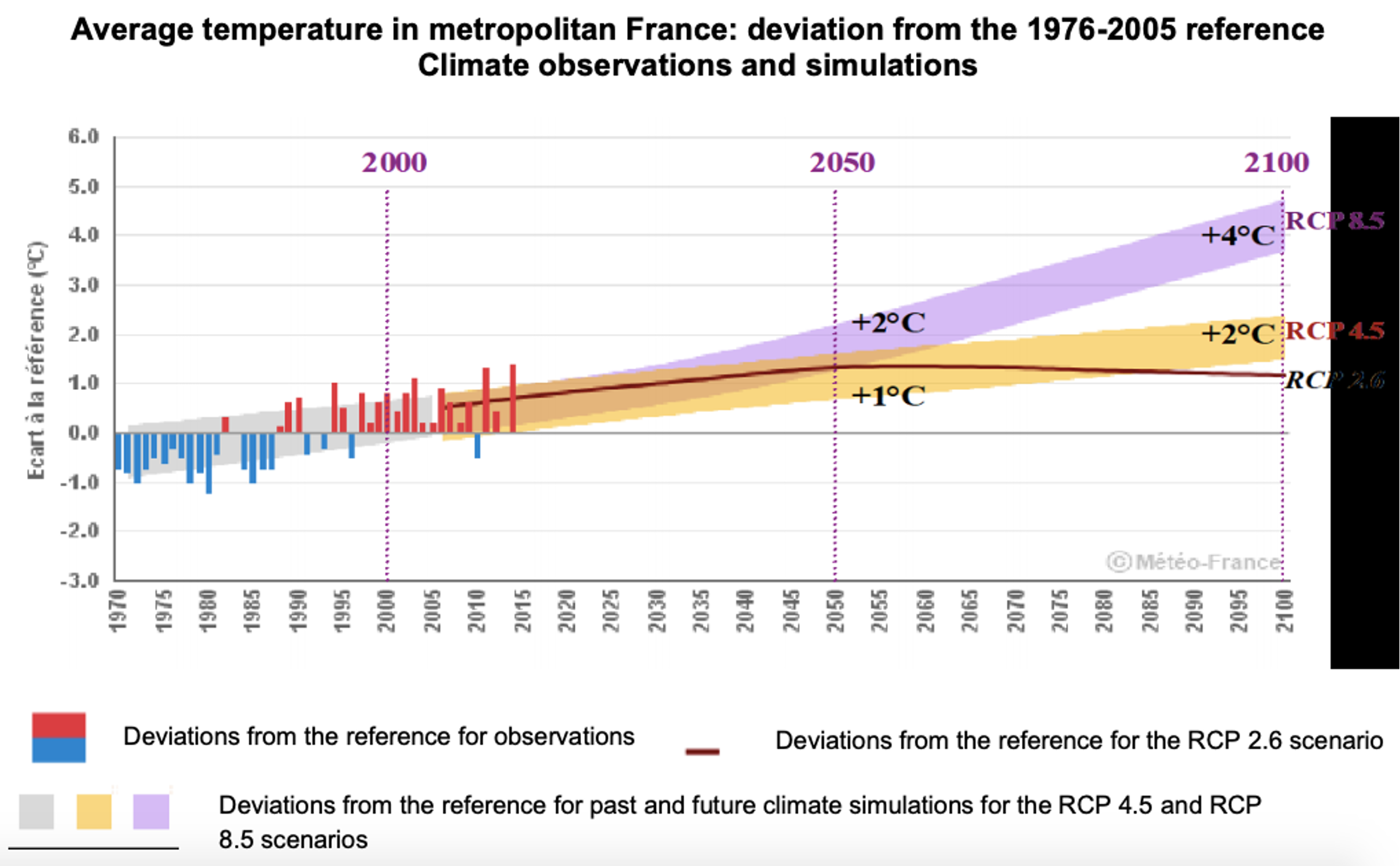

Physical risks were based on a “Business as Usual” scenario (the RCP 8.5 scenario from the IPCC - Intergovernmental Panel on Climate Change), assuming a temperature increase comprised between 1.4°C and 2.6°C on a 30 years’ time span to 2050.

Chart 5 - Physical risk assessment based on the RCP 8.5 IPCC scenario (source ACPR, p.33)

For insurance groups, the pilot exercise was split by property and human health damages, including mosquito-borne diseases, pandemics and air pollution, the human dimension being quite innovative in climate change stress testing. As a result, natural disasters are projected to double, and a surge in vector-borne infections and in air pollution impacts on health (“leading to respiratory and cardiovascular diseases, cancers, and premature deaths”) is expected between 2019 and 2050.

Loss-models were put in place as to assess the impact of a surge in natural disasters on the property damage business. It resulted in an escalation of claims throughout the French territory (though with large regional discrepancies), due to an increase in the scale and frequency of natural disasters. The stress test concludes that “premiums increase by between 130% and 200% over 30 years depending on the category, i.e., an increase in insurance premiums comprised between 2.8% and 3.7% per year”.

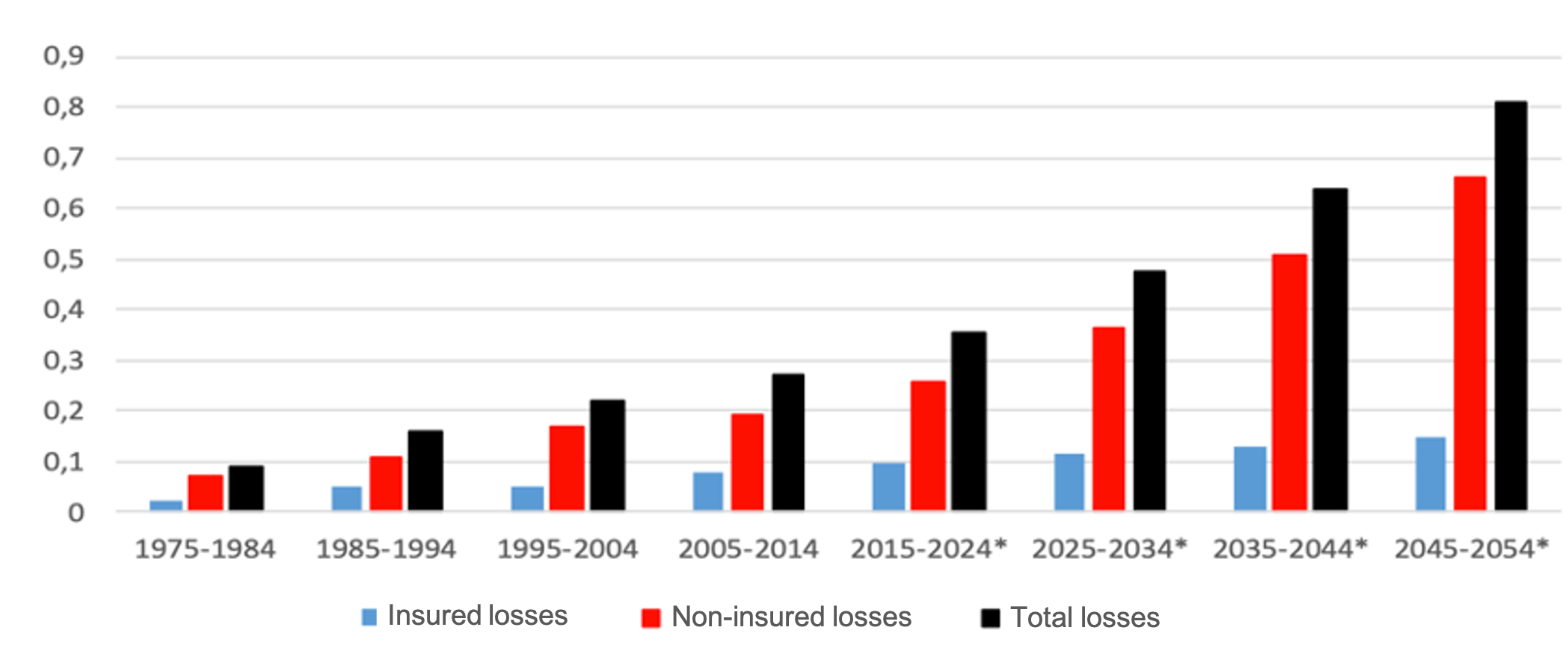

As yearly pricing review is common in the insurance industry, insurers are relatively protected against an increase in loss ratios caused by natural disasters. However, the long-term horizon used in these tests showcases an expected twofold increase in climate disasters, shedding light on the widening of the insurance protection gap (where some sectors will become too burdensome to be insurable – see Chart 6).

Chart 6 - Insurance coverage gap (% of world GDP)

Questions are raised by the exercise: which underwriting framework should be adopted to ensure that the most exposed geographical areas do not become uninsurable? As reinsurance will play a key role in supporting insurance, which legal frameworks should be put in place as to monitor this risk transfer?

For this exercise, insurers have not adopted any change in their reinsurance program. The share of premiums ceded under reinsurance program decreases, while the absolute amount of ceded premium increase by 2050. The gradual decrease in the share of ceded premiums therefore appears to be mainly driven by the insurers' assumption that the claims/premiums ratio will remain stable over time.

Banks were not able to fully participate on the physical risks’ side. The limitation being due to the absence of key exposure data (counterparty and geolocational data) and methodological difficulties regarding risk transmission channels (from physical risk to traditional risk categories). Those limits are those identified to develop a new set of prudential rules integrating climate-related financial risks, in a recent set of reports from the Basel Committee on Banking Supervision (read the analysis of Carbone 4).

A pioneer exercise to become an industry standard

The ACPR already advanced it will perform more regular climate stress tests (planned for 2023/24). The results of this test will also enable to better prepare for the upcoming exercise which will be undertaken by the ECB in 2022. Other international working groups will involve the European Insurance and Occupational Pensions Authority, the Basel Committee on Banking Supervision, the International Association of Insurance Supervisors and the Financial Stability Board.

We recognise that this assessment is unprecedented in financial institution stress testing, paving the way for further reflection in the broader EU Sustainable Finance Agenda. This pilot exercise aims at supporting both those targeted economic actors and regulators to take decisive actions on the herculean tasks awaiting in tackling climate change.

This encouraging pioneer exercise has shown that some progress could be made with the help of improved methodologies and key climate change data. Advances in climate disclosure requirements (notably the revision of the directive on non-financial reporting) and reliance on bottom-up, forward-looking and granular climate data will be decisive in these regards.

------------

Article written by Victor Murzeau, Carbone 4 consultant, and Mona Huys, Carbon4 Finance carbon data analyst.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.