Carbone 4 launches Carbon Impact Analytics, an innovating method to measure the carbon impact of an investment portfolio

For an investor or an asset manager, measuring the impact of financial investments on climate change is a vital stage of portfolio construction which contributes to the transition towards a low- carbon economy.

Carbon Impact Analytics is an innovative methodology which measures the carbon impact of an investment portfolio, by:

- Measuring greenhouse gas emissions produced or avoided by the companies held in a portfolio, throughout their entire value chain (scope 1, 2 and 3). Carbon Impact Analytics also measures emissions produced or avoided by products and services sold;

- Assessing a portfolio’s contribution to energy and climate transition.

Carbon Impact Analytics thus measures greenhouse gas emissions associated with investment assets and their contribution to emission-reduction, which is now a regulatory requirement under article 173 of the Energy Transition for Green Growth law. It is also a decision-making tool which can be used to rotate investments towards companies which are contributing to energy and climate transition, via their “green” business activities. Asset managers are provided with a detailed analysis of the carbon impact of the companies held in their portfolio and the results can be consolidated across the entire portfolio. The methodology used in the initial version, covers global equities and bonds issued by listed companies.

The analysis, which is carried out on a company-by-company basis, aims to encourage dialogue with the companies over time. Carbon Impact Analytics has been developed in partnership with Mirova, the responsible investment subsidiary of Natixis Asset Management and with the support of MAIF.

Carbon Impact Analytics methodology “Bottom-up” analysis

The carbon impact analysis of a portfolio begins with a detailed assessment of each individual investment. An aggregate weighting of the results is then established for the entire portfolio. The Carbon Impact Analytics evaluation thus differentiates between companies within the same business sector and assesses the efforts they have undertaken to integrate climate issues into their strategies, in order to implement a stock-picking approach based on carbon impact criteria.

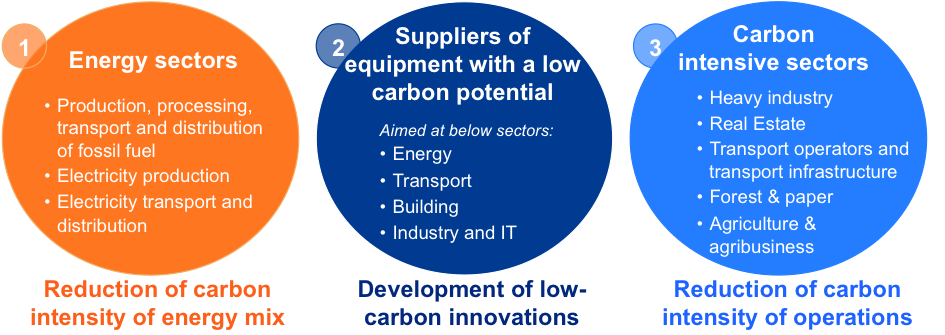

Sectorial approach with specific insights for “high stakes” sectors

The challenges for low-carbon transition vary according to economic sector, both in terms of leverage to reduce emissions and also in terms of innovation. For this reason, Carbon Impact Analytics proposes a specific approach for the most challenging sectors, using a different methodology adapted to each sector.

The quantitative emission assessment (produced or avoided) is complemented by a qualitative trend score. On the basis of these elements, a global score is attributed to each company, providing an evaluation of its contribution to climate transition. A detailed presentation of the Carbon Impact Analytics results feeding through to reporting and investment strategy

The results of the Carbon Impact Analytics evaluation are consolidated across the entire portfolio and provided for each company. The results include a range of quantitative and qualitative indicators, as well as statistical data for the entire portfolio.

Press contact Carbone 4

Coralie Malbet - Tel : +33 (0)1 76 21 10 00 coralie.malbet@carbone4.com

About Carbone 4

Founded by Alain Grandjean and Jean-Marc Jancovici, Carbone 4 is a leading independent consulting firm specialized in energy transition that offers its expertise to private or public players. Convinced that anticipation of the constraints of climate change is the best option, Carbone 4 assists its clients to help them transform these constraints into a tremendous innovation accelerator, a commercial differentiator and a motivation for teams. In the financial sector, Carbone 4 develops methodologies and tools adapted to each business to enable them to measure and highlight the carbon impact of investments and their contribution to the energy transition. www.carbone4.com

About Mirova

Mirova offers a global responsible investing approach involving Equities, Fixed Income, General and Renewable Energy Infrastructure, Impact Investing, and Voting and Engagement. It has €5.6 billion in assets under management and €42.9 billion in Voting and Engagement. Its team of 50 multidisciplinary experts include specialists in thematic investment management, engineers, financial and environmental, social and governance analysts, project financing specialists and experts in solidarity finance. www.mirova.com

About Natixis Asset Management

Natixis Asset Management ranks among the leading European asset managers (1) with €328.6 billion in assets under management and 649 employees (2). Natixis Asset Management offers its clients tailored, innovative and efficient solutions organised into six investment divisions: Fixed income, European equities, Investment and client solutions, Structured products and volatility developed by Seeyond, Global emerging developed by Emerise, and Responsible Investing developed by Mirova.

(1) Source: IPE Top 400 Asset Managers 2015 ranked Natixis Asset Management as the 46th largest asset manager based on global assets under management, and by the country of the main headquarters and/or main European domicile, as of 31 December 2014.

(2) Source: Natixis Asset Management - Natixis Asset Management Asia Limited as of 30 June 2015. Reference to a ranking does not indicate the future performance of the fund manager. Seeyond is a brand of Natixis Asset Management. Emerise is a brand of Natixis Asset Management and Natixis Asset Management Asia Limited with teams in Paris and Singapore. Natixis Asset Management Asia Limited is an asset manager, 100% subsidiary of Natixis Asset Management. Mirova is a subsidiary of Natixis Asset Management.

About Natixis

Natixis is the international corporate, investment, insurance and financial services arm of Groupe BPCE, the 2nd-largest banking group in France with 36 million clients spread over two retail banking networks, Banque Populaire and Caisse d’Epargne. With more than 16,000 employees, Natixis has a number of areas of expertise that are organized into three main business lines: Corporate & Investment Banking, Investment Solutions & Insurance, and Specialized Financial Services. A global player, Natixis has its own client base of companies, financial institutions and institutional investors as well as the client base of individuals, professionals and small and medium-size businesses of Groupe BPCE’s banking networks. Figures as at June 30, 2015

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.