Designing low-carbon indices based on Carbon Impact Analytics indicators

Since 2010, Carbone 4's team of energy and climate change specialists has proven expertise in the financial sector.

Carbon Impact Analytics – a methodology co-developed with Mirova, Natixis subsidy specialized in responsible investment – equips investors and asset managers with the tools necessary to reduce their climate-related risks but also to seize the opportunities offered by the ongoing energy transition.

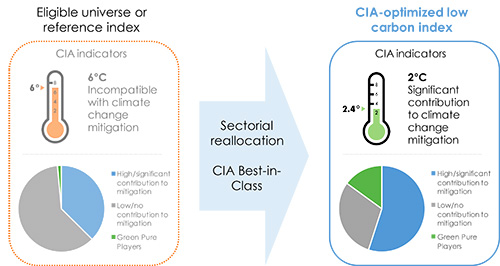

As a result of studies carried out for Euronext and Cambridge University’s Investment Leaders Group, Carbone 4 releases its conclusions on low-carbon indices through a comprehensive report. In this report, Carbone 4 offers a detailed look into how our indicators can be used to either

- reallocate an existing portfolio or index to achieve maximal carbon performance or

- build new low carbon indices from the ground up, drawn from Carbone 4’s ever-growing database of CIA-analyzed firms.

Indeed, Carbon Impact Analytics-based indices stand out from other low carbon indices on the market for several reasons: - inclusion of indirect emissions (Scope 3) enabling to account for the transition risk : a standardized and consistent approach that allows for accurate comparison of index constituents (including those within the same sector);

- inclusion of emissions savings : a measure of the opportunity associated with investment in an index, not only the risk;

- customizable index building : decision criteria adapted to investor needs. ...

To access the full report, click here.

For an in-depth look at CIA methodology, refer to the CIA guidebook.

To learn more about Carbone 4’s many low-carbon investment services, contact us here